As the market was rising from the depths of February’s late sell-off this past week, what was your plan?

Were you planning on chasing stocks higher in a fit of FOMO, or did you take a step back to think through your market outlook going forward and how you wanted to trade it?

Folks, I’ve been trading for 20 years and I can’t tell you how many times I’ve been burned chasing stocks.

That’s why this week’s Bullseye Pick was all about being a buyer on pullbacks, which is a discipline that will change your trading career for the better once you get the hang of it.

Now, my outlook on the market, as I alerted members to at the start of the week, is that we are going higher.

Along the way, though, I also told members that I expect that there will be a lot of turbulence and potential buying opportunities.

Among the many signs that we at RagingBull are seeing to suggest a market turnaround is taking shape is the fact that penny stocks look like they are heating up again.

So, right now I am looking to build positions across a number of different stocks during pullbacks, and I am starting by watching a growth stock that has strengthened more than any other growth stock that I follow since its February lows.

So, before we get started I should point out something that you might not be aware of.

As you’ve probably come to realize, the markets are ALWAYS changing, and good traders have to know how to become nimble in their positioning in order to account for these changes.

I can’t promise that I always have the right answer, but as this screenshot from a recent communication with one of my members reveals, I do respond to member comments.

Right now, we’re in what I call a “prove it to me” market, where companies are being forced to show their growth and strong earnings.

Those companies that are able to do so are being rewarded, and that’s what we’re seeing with Upstart Holdings Inc. (UPST) right now.

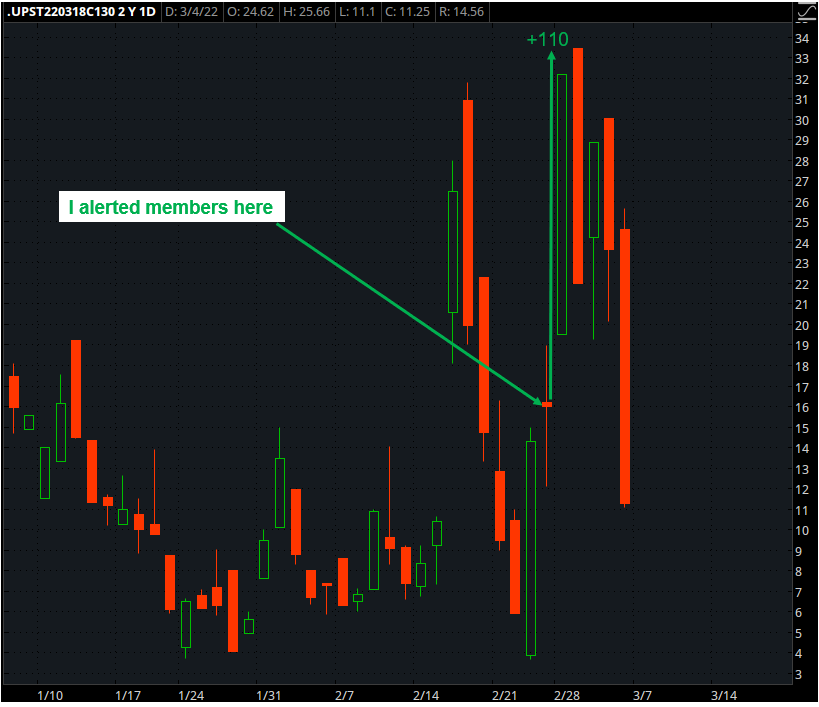

As you can see from this chart, UPST has risen more than 100% since it bottomed in February.

That’s the most of any growth stock that I follow, and I follow a lot of growth stocks.

But it’s also a testament to the company’s actual growth and earnings.

Technically, I should reinforce that I like to put stocks that have been beaten down on my radar after they have been able to climb their way from being extremely oversold back to the middle average of my Keltner Channel setup.

You can see this on the chart below, where UPST traded at 3X the daily ATR below the middle average in late January, but gradually found enough buyers to firm things up back to the average.

Stability since then has been a strong sign that negative sentiment has been flushed out, allowing for better odds that a new bullish trend can start to develop.

Admittedly, I wanted to enter UPST sooner, but I wasn’t sure how the stock was going to react to earnings back on 02/16/22.

Unless you’re using multi-leg options strategies like “strangles” that can benefit from the large swings that often follow an earnings announcement, traders should make it a point to avoid trading right ahead of earnings reports, due to the uncertainty of the event.

You can always enter the trade after the dust settles after earnings, and that’s part of my plan with UPST.

Now, the other thing I like about this trade idea is that the stock has been so volatile of late that you don’t even have to trade the options to capture big percentage swings.

Basically, this stock moves so much on any given day that 10% to 20% swings in just a couple of days are a common occurrence.

That said, I should probably remind you of the power of options.

Specifically, the 110% Monday to Tuesday (just 2 days) surge in the 18 Mar 22 $130 calls I showed in the screenshot above is something to behold.

Now, my original Bullseye Pick this past week on Monday was to buy UPST common stock at an entry price of $125.

Due to the early-week strength in the stock, it never had a chance to get there.

That is, however, until the world changed yet again after Russia attack Europe’s largest nuclear power facility on Thursday evening.

Now that $125 looks like it may be tested because of this development, I don’t want to buy a dip until $110 gets tested.

I want to see that get tested a few times before I enter.

$110 would be the lower end of the -1 ATR range.

I don’t expect a strong stock like that to fall below there, but you never know in this market.

To YOUR Success!