On July 11th, the Euro 2020 Tournament was finally played after facing a COVID-19-related delay. The tournament, which pinned the best soccer teams in Europe against each other, crowned Italy as the champion over England in a thrilling match that was decided by penalty shots.

In terms of US viewership, the Euro 2020 Final was the most viewed Euro tournament game ever, with 6.5 million viewers.

Viewership for the Euro 2020 tournament was up 31% from the 2016 tournament, and the strong ratings come at a time when the popular media company that aired the game is about to hike membership fees for one of its services, in a move that signals the company is starting to view the service as a stand-alone product.

Recent events have led to a breakout in this stock’s price, resulting in a pre-earnings setup that creates a strong foundation for premium sellers to set up a bullish trade.

I’m about to show you how to set this trade up in a manner that offers you defined risk against a well-defined area of protection.

Disney is making moves, causing positive rotation in its stock price

Disney is set to hike the monthly subscription fee for ESPN+ by one dollar, though the bundle that includes the sports streaming service will remain the same price.

In August 2021, Disney will hike monthly subscription fee for ESPN+ up to $7 a month, up from $6, in a move that mirrors a similar price hike for the Disney+ streaming service back in December 2020.

After a hugely disappointing 2nd quarter, where the stock returned -5.3% vs. the S&P 500’s +8.6% return, Disney stock has started to turn the corner recently, rallying above a 5-week range to levels not seen since mid-May this past week.

Fueled by a combination of recent bank upgrades, its highest grossing movie release (Black Widow) since the start of the pandemic, and the above-mentioned ESPN+ price hike, this breakout puts the stock into a bullish momentum regime for the first time since March.

With earnings now just one month away, at a minimum this price and momentum rotation offers favorable odds that a floor is being put in place.

Since there is no pattern indicating price is poised to rally aggressively from here, which would favor the purchase of call options, but we do feel that the bias is starting to rotate bullishly, the highest probability trade would be one that will benefit from limited downside risk and the passage of time.

I’m talking about a vertical credit spread.

We’ll talk about the specifics of this trade in a little bit.

For now, let’s look at the chart setup.

What are the technicals suggesting?

Although hindsight is 20/20, we should start our analysis by looking at some of the technical developments that may have helped a trader determine that price was close to forming a bottom earlier this month.

To begin with, the bullish July 8th reversal formed after DIS opened near a confluence of support levels, which came in the form of the mid-May pivot area and rising 200-day moving average (see green circle on Figure 1).

On its own, this gathering of big support levels was enough to indicate that, at a minimum, some degree of technical bottom feeding was likely to develop in that area.

The more bullish developments at the time, though, came from positively diverging momentum and volume accumulation (see top 2 studies on Figure 1).

Specifically, the downside approach to the aforementioned support bundle in the $167 to $170 area was accompanied by positively diverging RSI and MACD momentum indicators (an indication that downside momentum had slowed) and by a rising Accumulation/Distribution line (an indication that there was net accumulation of shares during the early-July price slide).

Figure 1

How can a trader benefit from simply having a bullish bias?

At RagingBull, we’re all about finding the chart setups with favorable profit potential and minimum risk.

When it comes to risk management, perhaps no options strategy is better suited than the vertical credit spread.

Let’s walk through the particulars of how we would want to go about placing a vertical credit spread known as a “bull put spread” for DIS in the coming days.

When it comes to learning multi-leg options strategies, vertical credit spreads are among the easiest, and are therefore a great place to start.

Why are they relatively easy to comprehend?

Because they include either selling one put and buying one put (bull put spread) or selling one call and buying one call (bear call spread), and only include options of the same expiration month.

The maximum gain that can be earned from a credit spread is the net credit, realized when both options expire out of the money.

The maximum loss potential is the difference in strike prices – net credit. Realized when both options expire in the money.

In the case if DIS, the trade setup would be as follows:

- Identify the trade bias (we’ve identified a bullish setup)

- Identify where the stop-out level is (let’s call this the anchor point).

- Identify the strike levels that will allow you to enter the trade with what would ideally be no worse than a risking 4 to make 1 setup. There is some leeway here, but generally you should try not to risk more than 4 to make 1.

Let’s break each bullet down a bit further.

For bullet 1, the highest probability trades usually occur when a trader is trading with the trend, not against it.

In this case, we’re using the higher slope of the 200-day moving average as our indication that the long-term trend is up.

For bullet 2, we identified earlier that the 07/08 pivot low formed near an area of major support.

If the long-term uptrend is to continue as part of our original thesis (i.e., the reason for entering the trade in the first place), then price cannot fall below the 07/08 pivot low.

Therefore, the 07/08 pivot low of $169.81 is the ideal stop level (i.e., the anchor point).

When it comes to bullet 3, this is where we must start exercising patience.

I’m constantly preaching how important it is not to chase trades and to let the trade come to you.

When it comes to this DIS trade idea, the trader’s ideal spread entry would be for him or her to be able to sell a put option that anchors as close to the $169.81 pivot low as possible and buy a put option with a strike that is roughly $5 to $10 below that area.

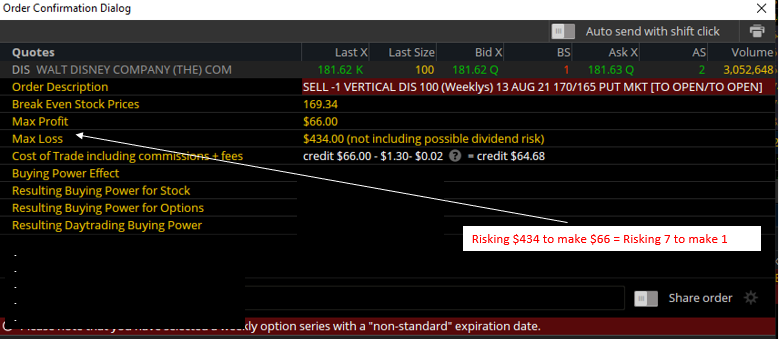

As figure 2 below reveals, however, at the time of this writing on 07/16, with the stock trading near $181.64, in order to anchor the trade near the $169.81 pivot low would require the trader to take on a risk/reward profile of 7/1.

Figure 2

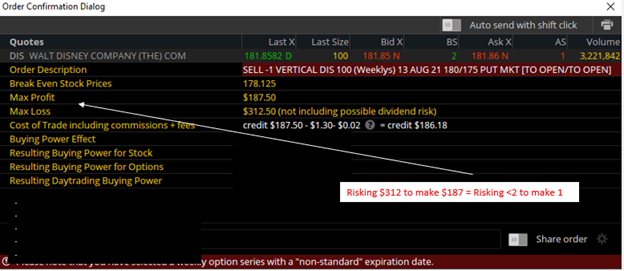

Now, there are a lot of traders that would take a much more aggressive approach than this, by establishing a spread that is much closer to the current price of $181.64 to create potential to collect a much larger credit and a better risk/reward profile.

At the time of this writing, that risk reward setup would have looked something like this.

Figure 3

While this is an ideal risk/reward setup with the largest profit potential, there is an issue that many new traders only learn through practice.

The problem with this approach, is that after such a relatively large price rally like the rally staged by Disney’s stock from 07/08 to 07/12, the potential for a deeper pullback is elevated.

If a deeper than usual pullback happened to occur, it would cause the spread to generate an unrealized loss in the portfolio in the early stages of the trade, before theta decay has had a chance to accelerate, that will be rather uncomfortable and may result in the trade stopping out prematurely.

Remember, there are thousands of stocks that are available to trade.

You don’t have to trade everything and the ones you do trade should be traded on your own terms.

Therefore, if you really like the trade and feel that there will be a minimal pullback as the trend starts to rotate higher ahead of earnings, you could look for the next big level of support that exists before the 07/08 pivot low of $169.81.

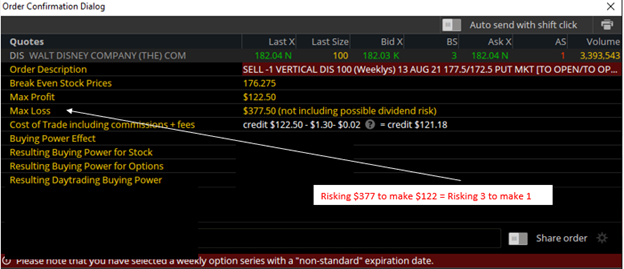

As Figure 1 above shows, that support area is $178.50 to $176.50 (see green line on Figure 1), where the 07/12 breakout point combines with the 34-day moving average (not shown) and 50% retracement of the 07/08 through 07/12 rally (also not shown).

If a trader happened to sell a put to anchor the “bull put spread” in the $178.50 to $176.50 area at the time of this writing, the trader would stand to collect a smaller premium than in the example above; however, Figure 4 below shows the risk reward setup (3/1) would be far more favorable than the 7/1 ratio that would have been established in the first example (see Figure 2).

Figure 4

Bottom Line

In today’s example, establishing a vertical credit spread to reflect a trader’s bullish bias during the lead-up to earnings would limit a trader’s profit potential vs. buying just straight calls (buying calls offers unlimited profit potential).

However, the defined risk of a vertical credit spread (calls have undefined risk) and theta-friendly nature of these trades (vertical spreads benefit from the passage of time, whereas the value of a call option deteriorates over time) give these trades a much higher probability of success than just buying straight calls.

Though favorable in terms of their winning rate, placing these trades at the wrong level too early into the trade does open the door to large account drawdowns that may force the trader to exit the trade prematurely with a loss.

That’s why it is so important to be patient and always work with the price chart to find setups that fit your risk/reward comfort zone.

1 Comments

Jeff,

I love your credit spreads. You use stable companies with price ranges perfect for earning a few thousand dollars without having to buy a boat load of contracts.

In your Disney preamble before your bullet points you describe a credit spread as selling 2 calls or 2 puts.

I don’t want to tell you your business, but I believe a credit spread is selling one call and buying another, ‘the spread’ being the difference in price, which is what is credited to your account’ immediately upon execution of the trade.

You then need to monitor that trade until expiration, or set stops to take you out of it if price movement reverses.

You refer to it accurately as ‘premium’. In the insurance business when a company sells you a policy you pay them a premium for that policy protection. They will then sell that policy to a larger “reinsurance” company that spreads it’s risk for a premium less than the amount they collected, keeping the ‘spread’.