After a week like we’ve just had in the markets, I hope that you are taking time to unwind and prepare for what lies ahead in the coming week of trading. I know I am.

Folks, this is real trading and old-school price action, not that easy street, Fed-supported trend trading that we were fortunate enough to experience from the Mar 2020 lows to the late 2021 highs.

It’s time to put every technical tool, every trading strategy, and every risk management principle you’ve been reading about to the test.

Now, there is one candlestick pattern that was prominent across the markets this week, and it could have important implications for your short-term trading decisions.

This formation was so prominent it actually showed up across a number of the stocks and ETFs my team and I have been watching, so let’s take a closer look at what it means for our trade ideas, and the broader market, heading into the new week of trading.

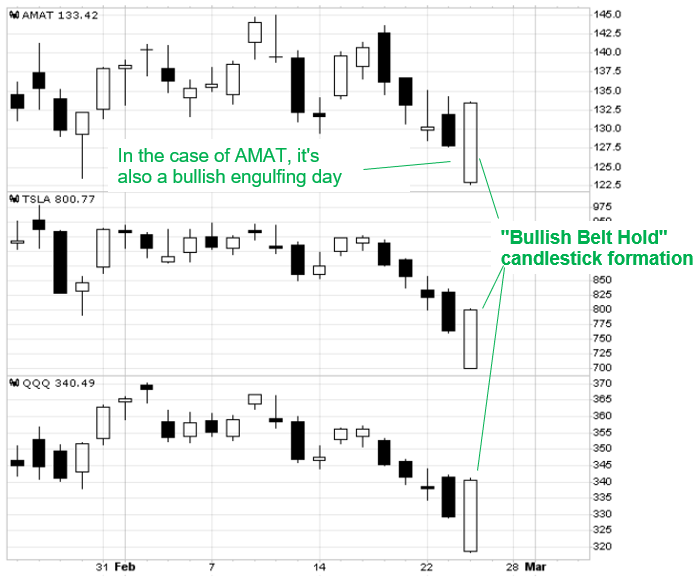

For the purpose of this exercise, I randomly chose 3 charts of stocks and ETFs my team and I have been following of late, like Tesla Inc. (TSLA), Applied Materials (AMAT) and the Investco QQQ Trust (QQQ).

When you look at these charts, what is it that they all have in common?

You see it?

Look at Thursday’s price action!

That’s right, Thursday’s trading action formed the identical candlestick formation across all three charts.

This formation, known as “bullish belt hold,” forms when an overnight sell-off causes the stock to open at the lows, which causes an extreme oversold condition that is immediately bought by bargain hunters who continue to buy throughout the day until the stock closes near the day’s highs.

Like many bullish candlestick formations, the message given by this formation is that a bearish to bullish sentiment shift has occurred, and that the lows of this formation should be respected as an area of support, at least for the short-term.

Now, AMAT is a stock we have been watching as it forms what Mike Parks, Raging Bull’s Senior Training Specialist, looks like a weak “double bottom” price pattern.

Specifically, this double bottom has been taking shape with a bearish TTM Squeeze, momentum pointing downward, and the On Balance Volume showing bearish divergence.

If you know Mike and me well enough, you know that we have no problem waiting for a trade to come to us before we enter a position.

This patience has gotten us to where we are today.

That said, the development of Thursday’s bullish belt hold candlestick formation and bullish engulfing day has Mike doing two very important things right now:

- Respecting Thursday’s lows as a level that can hold as support for the short-term.

- Not looking to rush into a bearish trade and actually looking for AMAT to confirm a breakdown below $121.45 before he executes a “bear call vertical spread.”

Why a bear call spread instead of buying straight puts?

Because AMAT’s Implied Volatility is relatively high right now, which means those puts will be relatively expensive, and this gets back to the core of what you need to think about when becoming a buyer of options.

Yes, Mike is limiting his profit potential with a call spread.

However, he is also greatly increasing the odds of success since he’ll be collecting the expensive premium that has resulted from the increased volatility, and benefiting from the passage of time.

Here’s Mike’s trade idea on AMAT, if a breakdown occurs:

My trade:

- Entry Below $121.45

- Sell: 18 Mar 140/145 Credit Call Spread

When would a trader use a bear call spread?

This trade is best utilized when a trader has a neutral to bearish opinion of a stock or ETF.

Since the trader is a net seller and collecting a premium, the trade benefits from both time decay and falling stock prices.

The trade is also statistically proven to provide better odds of success than many other trading strategies.

What are the basic mechanics of a bear call spread?

A bear call spread is the easiest multi-leg options strategy to learn because it consists of one short call with a lower strike price and one long call with a higher strike price, both of which have the same expiration date.

Since the trader is selling the call with the higher premium (i.e., the price you pay for the option, not the strike price), a bear call spread is established for a net credit (or net amount received).

The trade profits when the value of the spread declines over time.

What’s the maximum profit potential?

The trade can only make as much as the net premium received when the trade was established (minus commissions).

The maximum profit is realized if the trade is held through expiration and both calls expire worthless.

What’s the maximum loss potential?

To find the maximum that can be lost on the trade, find the difference between the strike prices minus the net credit received (plus commissions).

The maximum loss risk is realized if the stock price is at or above the strike price of the long call at expiration.

What’s the breakeven point of the trade?

To find the breakeven point, take the strike price of the short call (lower strike) and add it to the net premium (credit) received.

To YOUR Success!

2 Comments

I am confused. If you are stating that we should use that bullish formation as a support then should we not expect the price to increase in the short term? Why would we choose a bearish position when the chart is showing a support?

Oh ok never mind… when you sell a premium you are anticipating the market to do the opposite correct? Meaning if you sell a short then when the market increases you make money because the buyer essentially losses the opportunity to call. 🤦🏽♂️