Tesla inc (TSLA) is finally facing some stiff competition as legacy automakers flood the market with their own electric cars. This might be bad news for TSLA as its share of the electric vehicle market gets chipped away at. However, there is one sector that stands to benefit from the significant increase of electric vehicles that are about to hit the roads.

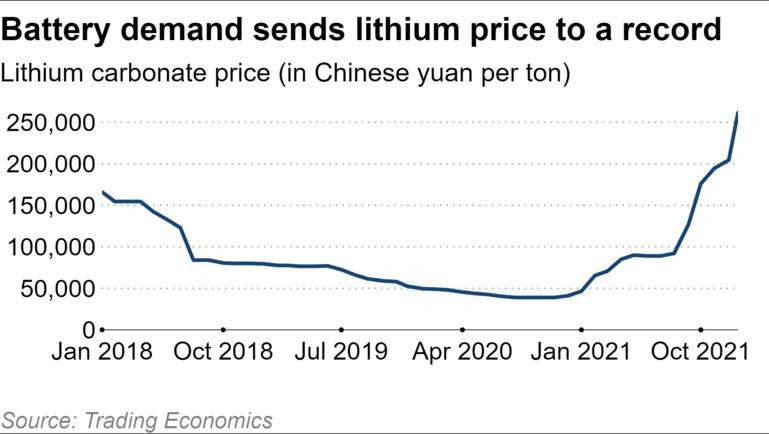

Lithium is a key component required in the batteries that power electric cars. Increasing demand is starting to outstrip supply, and the price of lithium is at historical highs. Not only this but as inflation worries hit tech stocks, money might be rotated into the commodities sector.

Worldwide money printing has led to inflation i.e. higher prices for raw materials, and who benefits from this? The miners of these raw materials!

One of the few companies with exposure to American lithium is Lithium Americas Corp (LAC). This is one of my favorite trade ideas right now and it could continue much higher!

Fundamentals

Lithium Americas Corp. (LAC) operates as a resource company in the United States. The company explores lithium deposits. It owns interests in the Cauchari-Olaroz Project located in Jujuy province of Argentina, and the Thacker Pass project located in northwestern Nevada.

According to Bloomberg NEF, global electric car sales are estimated to have reached 5.6 million vehicles in 2021 from 3.1 million in 2020. Further demand growth in 2022 will mean a lithium deficit this year as the use of the material outstrips production and depletes stockpiles, according to a December report from S&P Global.

The report said that according to S&P Global Market Intelligence, supply is forecast to jump to 636,000 metric tons of lithium carbonate equivalent in 2022, up from an estimated 497,000 in 2021 — but demand will jump even higher to 641,000 tons, from an estimated 504,000.

I expect this trend to continue as more and more people choose to purchase electric cars over combustion engines. Commodities cycles can run for years and years, so this could be just the beginning for miners like LAC.

Technicals

LAC is currently just over 30% off the highs of $41.56 made back in November, currently trading at around $27.50.

A prior major level of resistance was $28.75, which was made back in January 2021. If LAC can start to base above this prior resistance and become support, that would be an area I would take a trade for a possible move back to the all-time highs.

Alternatively, the 200-day moving average is trending higher and has acted as a support in the past. It is currently at $22.34, so a drop to this area would also get my attention for a possible entry.

I am not quite ready to pull the trigger on this one just yet and am waiting for some more confirmation from the technicals and for my indicators to line up. But I love the fundamentals in LAC here, so am watching this stock closely!

Bottom Line

As inflation and interest rate fears decimate tech stocks, there are other sectors of the economy that may benefit. Higher prices for raw materials, whilst being a negative for the consumer and companies who use these materials, are great for the miners of these materials.

Lithium is a key component required in the batteries that power electric cars. As legacy automakers produce more and more electric cars, and motorists change their habits and buy more of these vehicles, the demand for batteries and their components increases.

Increasing demand for lithium is starting to outstrip supply, and the price of lithium is near historical highs. One company that can continue to benefit from this is Lithium Americas Corp (LAC). I am watching this stock closely as I love the fundamentals here. As soon as the technicals line up and I am ready to pull the trigger, I will be sure to let subscribers know!

3 Comments

Great Report

Thank you for that great info Robert! I’ve been looking into the lithium company Freyr, based out of Sweden. Have you heard anything about this company? I’d love to hear your thoughts on that! My financial advisor is being very hardheaded, and I think he’s lost his touch. I lost $21,000 from December 31 to present day. I realize the market is volatile but Jesus Lord come on! I’ve been studying the stocks just in case I have to pull all my investments out from his company he works under, because if he loses 5000 some dollars for me I will no longer be a millionaire. Then I’m gonna be irritated! I don’t pay anybody to lose my money, and he’s got me panicking with anxiety over what’s going on with my investments!. Van Eck is also buying into Freyr, So it sounds like it’s pretty good! Just saying… Thanks for all your help! Nancy S

Thanks Jeff