I spend hours each weekend pouring through charts. I don’t do this for fun! Even though it can be, I spend hours looking through countless charts because I need to review the prior week, spot trends and clues from the market, and identify potential trades setting up for the week ahead.

With the sheer number of stocks making impressive moves at the moment and breaking out of long-term consolidations, this is an exercise and practice which I like to do. There is no downside to doing this, only furthering trader development and upside!

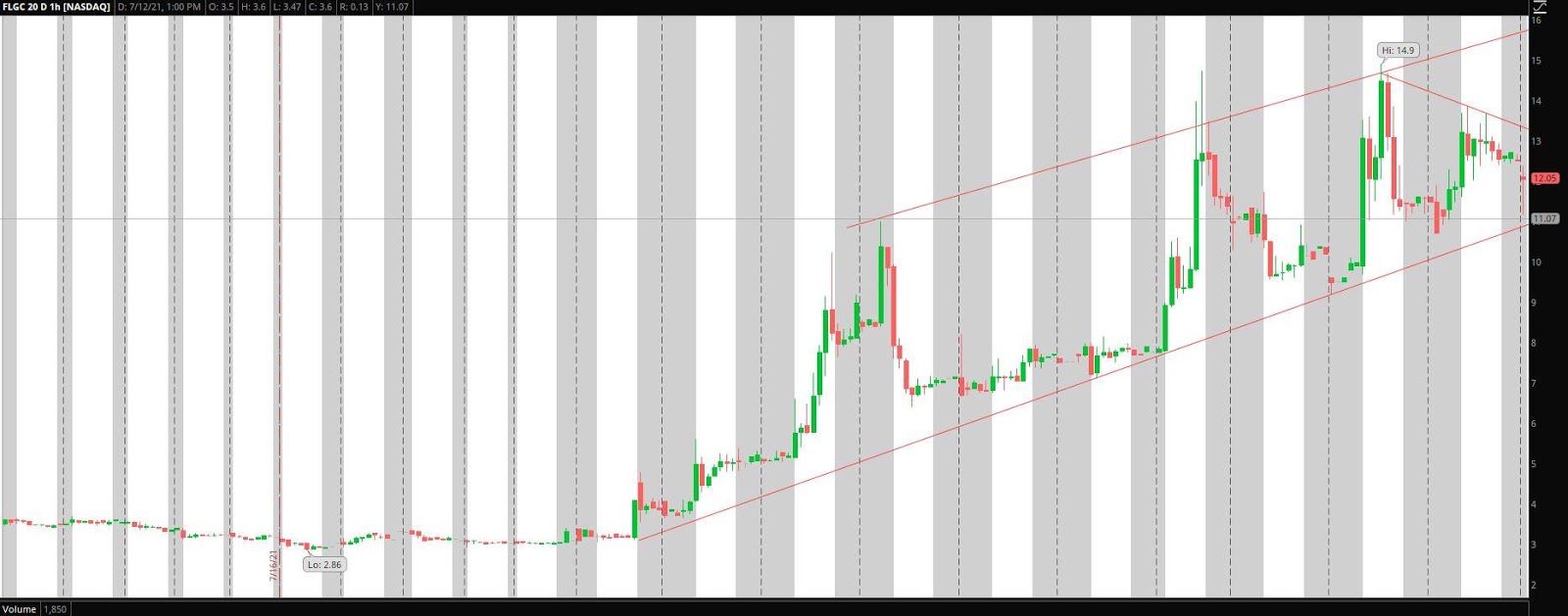

This exercise has put a new name on my radar: Flora Growth (NASD: FLGC)

FLGC, per Yahoo, is a cannabis company that cultivates, processes, and supplies cannabis products to pharmacies, medical clinics, and cosmetic companies worldwide. Some of the company’s brands include Mambe, Mind Naturals, Flora Lab, and Stardog Loungewear. FLGC was incorporated in 2019 and headquartered in Toronto, Canada.

Market Cap: 481.55M

Float: 33.31M

ATR: 1.79

Average Volume: 2.86M

FLGC has posted some severe gains since breaking out over $4!

The shares are up 162.21% year to date, up 264% on the month and 60.20% on the week.

What Caused The Breakout?

7/26/21 – FLGC broke above $4 on increased volume as the company applauded an update to Colombian cannabis regulations that substantially increased the company’s revenue potential.

7/27/21 – FLGC announced plans to partner with Avaria to distribute award-winning pain cream brand KaLaya across LATAM and produce its CBD formulations.

7/29/21 – FLGC executes an international sales agreement to enter the Australian market for medical cannabis and over the counter CBD market. The company also signed a letter of intent with an international distributor based in Australia.

With this string of press releases, it is no surprise that the company’s share price found a bid and broke higher. Later in the month, on August 19th, the company will hold its first half 2021 earnings call after the market close.

Why Is This On Breakout Watch?

Sure, the stock is already up 264% on the month; however, the chart and price action indicate that shares could still go higher. Let me explain:

The stock is currently in an uptrend, with critical support at $11 and resistance of the upward trend at $16. This means that the stock is likely to continue to trend higher as long as $11 continues to act as support. If $11 is broken and the stock spends time below support, with $11 turning into resistance, then the bull thesis will be over for the time being. This acts as a reason not to go long.

Thursday and Friday saw a steady increase in volume and put short-term resistance just above $13. The downward trendline from Thursday and Friday, connecting the highs of the two days, gives me a significant level for the short term. This area of $13 might turn into a critical inflection point within this uptrend, and if the stock breaks over $13 and bases higher, I could see the stock pushing towards $16.

Let’s Take A Closer Look:

Once again, $11 is vital because if the stock breaks below this area and holds below, the upward trend has been broken, and momentum could shift to the downside.

In the short-term, the bulls need the stock to hold above Friday’s resistance, $13 – $13.5, and then proceed to trade towards the resistance of the upward channel. This price action will signal that a breakout is on the cards and likely result in those who are short the stock covering their position and momentum bulls buying the stock for the breakout. This is an excellent recipe for a short squeeze.

The Bottom Line

I can’t predict the future. However, I can prepare for it. That’s what I have done here. Regardless of whether the stock goes sideways, up or down, it will not take me by surprise. This is because I have laid out what I would need to see to go long or not take the trade at all. Key support and resistance levels have been identified, and now I wait to see who wins the battle, the bulls, or the shorts, before I react appropriately.