Today I’m going to share with you my upcoming biotech catalyst watchlist. But before I do, I think its worthwhile to explain the process that goes into finding these stock plays.

Before meme stocks took over the stock market, biotechs were considered among the most volatile stocks to trade in the market.

Why?

Because of catalyst events.

Biotech stocks are highly susceptible to news events. Biotechnology companies often report Phase I, II and III data, which could move the stock.

Moreover, biotech stocks will tend to move around U.S. Food and Drug Administration (FDA) FDA approval dates and Prescription Drug User Fee Act (PDUFA) dates.

Biotech Stocks Trading – Spotting Catalyst Events

The good thing about trading biotech stocks is there’s a wealth of free information out there. For example, Finviz offers a great screener to filter for biotech stocks. You could look at technicals, fundamentals and descriptive statistics.

Let’s say you want to filter for biotech stocks with a market cap of more than $300M, average daily trading volume of over 1M and a short interest of over 20%.

You would see something like this.

If you see a chart pattern you like, you might want to put it on your watchlist. In a little bit I’ll share with you which ones have caught my eye and why.

Once you’ve filtered through the stock charts you can start looking for upcoming catalysts. Generally, biotech stocks run up into a catalyst event. I use Finviz to find patterns that signal a stock could potentially run. Thereafter, I would look at if the stock has a data release.

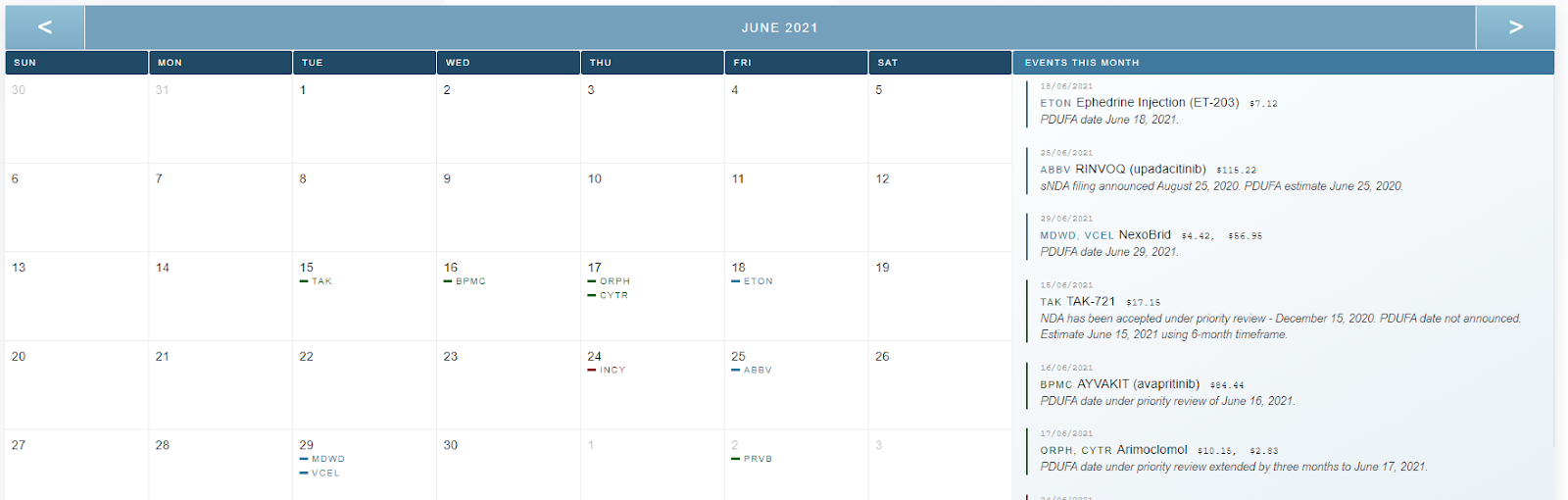

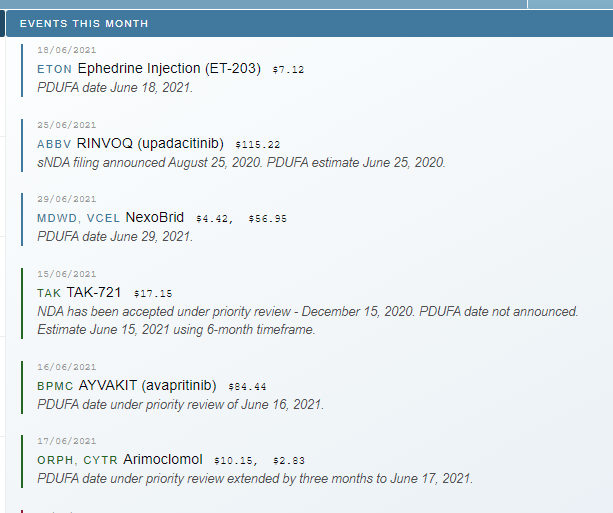

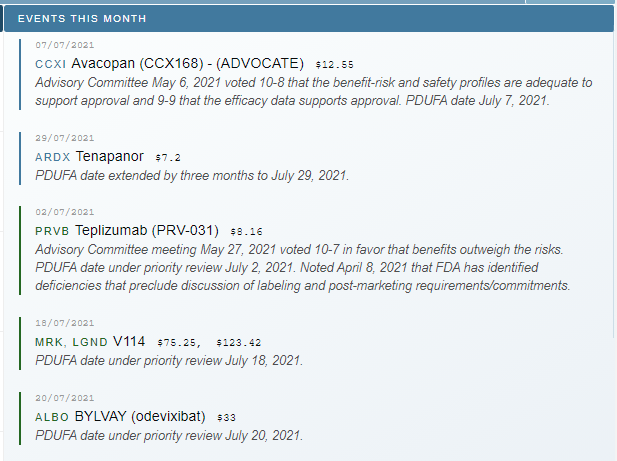

You could either use BioPharmCatalyst or FDA Tracker. Both offer premium subscriptions and are worth a look (I am not affiliated with nor is this a paid endorsement) . BioPharmCatalyst also offers a free PDUFA calendar.

Now, some catalyst events are more important than others. That said, let’s take a look at how to spot a catalyst event that could potentially move a stock.

Biotech Stocks Trading – How to Find Potential Stock-Moving Catalysts

Depending on the treatment and data, catalyst stocks may move a lot or not at all. Generally, biotech stocks move a lot on Phase II and Phase III data releases, but not as much as Phase I data releases.

I liked to jump in a few weeks before the catalyst date. For example, my focus would be on the upcoming July catalysts.

The type of catalyst matters

Typically, biotech stocks with treatments for cancer and other life-threatening illnesses tend to move on catalyst dates.

So it helps to research the treatment once you know when the catalyst event is expected to be released.

Shortly, I’ll share with you some upcoming catalysts I’m watching…

But before I do, allow me to explain how to take it a step further.

Biotech Stocks Trade – What to do After Finding Catalyst Events

It’s not difficult to find upcoming catalyst events. However, you’ll need to research the treatments and the disorder.

If there’s a significant need for the treatment, such as rare types of cancer, then the stock could move significantly.

Moreover, if you’re already in a stock position with an upcoming event, you should look for the exit sign before the event. The last thing I want to do is hold a stock into a catalyst event because it’s extremely risky.

For example, there are a plethora of events I was focused on and developed a watchlist.

Here’s a look at an example of how to create a watchlist.

Catalyst Swing Ideas

Arbutus Biopharma (ABUS)

Catalyst Dates: Phase 1 a/b data due at EASL meeting June 26

On Watch: Under $3.30

Action Area: Above $3.75

Stop Zone: Below $3.00

Iterum Therapeutics (ITRM)

Catalyst Dates: Expected FDA Approval Date of July 25th. Advisory committee meeting postponed as it’s no longer necessary.

On Watch: Under $1.50

Action Area: Above $1.90

Stop Zone: Below $1.40

CohBar (CWBR)

Catalyst Dates: Phase 1b topline data due early July

On Watch: Under $1.50

Action Area: Above $1.80

Stop Zone: Below $1.25

Ocuphire Pharma (OCUP)

Catalyst Dates: Phase 2 data due out late June

On Watch: Under $5.50

Action Area: Above $6.50

Stop Zone: Below $5

Biotech Stocks Trading Catalyst Events – Bottom Line

Once you’ve figured out how to spot catalyst events, it becomes easier to narrow down your focus. If you know when traders and investors are expecting a catalyst event, you could potentially trade biotech stocks for the run up into the event.

Now, keep in mind just because you know how to spot a catalyst event, it doesn’t mean you’ll become an expert in trading biotech stocks overnight. You need to build upon your foundation and understand how to find good setups based on the volatility of biotech stocks.

13 Comments

Thanks Kyle. Very helpful information.

Thanks Kyle, you’re the best

This is awesome information.

The points of leadership are well laid out and under stood.

I’m glad you’re back and training us again.

Good eye opener.

your training is gathering some momentum, pls keep it up.

welcome back

Thanks Kyle

U Rock

Very interesting inf

Really great insight!

Helpful ideas.

It’s really great to have you back.. appreciate all you do.