Friday saw shares of Flora Growth Corp. (NASD: FLGC) book its spot on the top gainers list, with the stock closing up 35.97% on the day. This move came after the stock was already up 264% on the month and 162% year to date.

Earlier in the month, I wrote about FLGC and why the stock was on breakout watch. The plan I outlaid in that article was spot on.

The breakout in FLGC was a textbook example of a technical breakout, and therefore I want to review the action along with my initial plan.

The stock initially caught my attention after I spent hours poring through charts over the weekend. This is an exercise and practice that I like to do because it keeps me in the know with current market trends, helps me review the prior week’s actions, and alerts me to potential trades.

The breakout in FLGC provides a solid teachable moment and opportunity for review! So let’s jump straight into it.

FLGC, per Yahoo, is a cannabis company that cultivates, processes, and supplies cannabis products to pharmacies, medical clinics, and cosmetic companies worldwide.

Market Cap: 531.65m

Float: 30.67m

ATR: 2.07

Average Volume: 3.05m

After Friday’s impressive breakout, shares of FLGC are now up 259.08% year to date and 434.16% on the month.

This impressive action follows a string of positive news from the company.

In my previous article, I mentioned the following press releases, which were catalysts for the stock to go higher:

7/26/21 – FLGC broke above $4 on increased volume as the company applauded an update to Colombian cannabis regulations that substantially increased the company’s revenue potential.

7/27/21 – FLGC announced plans to partner with Avaria to distribute award-winning pain cream brand KaLaya across LATAM and produce its CBD formulations.

7/29/21 – FLGC executes an international sales agreement to enter the Australian market for medical cannabis and over the counter CBD market. The company also signed a letter of intent with an international distributor based in Australia.

Then, on Friday the 13th, more positive news for the company:

8/13/21 – FLGC announced the availability of a broadcast titled “Colombia Challenges Canadian Cannabis Dominance.”

The Breakout In FLGC

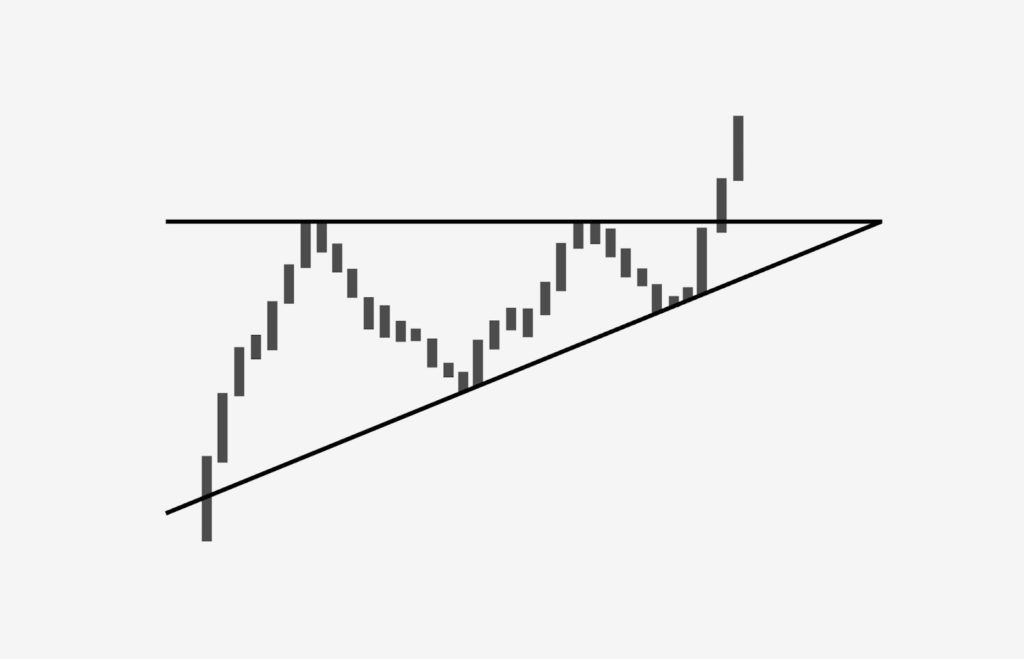

When I first wrote about the setup in FLGC, the stock was in an uptrend. Critical support was $11, and resistance of the upward trend was $16. Significant short-term resistance was just above $13.

My exact words were:

I also discussed the possibility of a short squeeze:

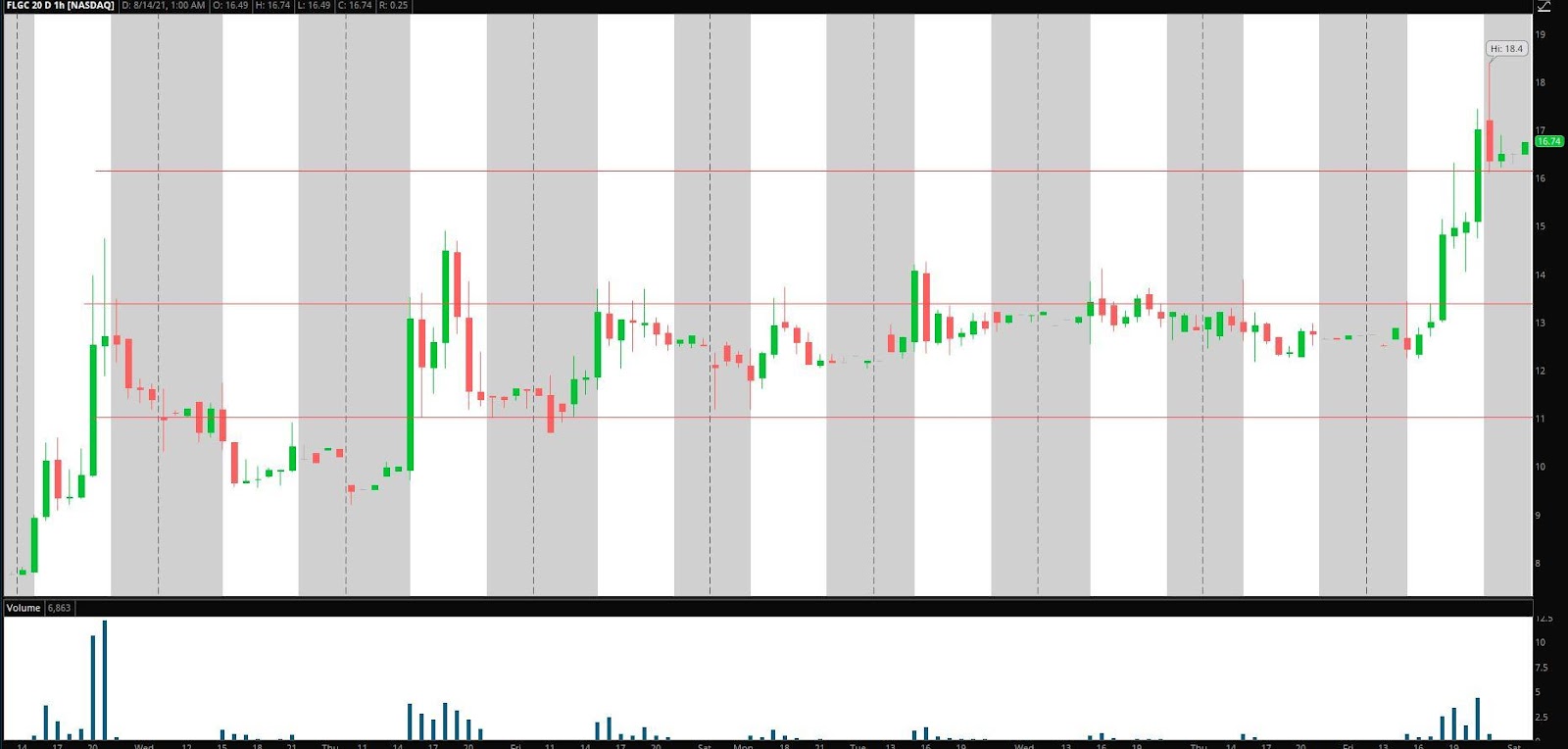

First off, the stock failed to hold below the critical support zone of $11. This is an excellent sign as price action is saying that bulls remain in control.

The next checkmark was that the stock began to base over $13. This signaled that a breakout could be imminent as the stock was trading above a critical inflection point.

On Friday, volume increased significantly, and the stock broke out of the consolidation and held firmly above.

The above intraday chart tells the story perfectly. As soon as the stock got above $13.50 resistance, volume increased significantly. Typically, volume is the lowest midday, so the fact that volume increased midday aggressively and above this crucial area was an excellent sign for further upside and momentum.

The target I spoke about and planned for was $16, as this was the uptrend’s resistance. The stock wasted no time trading to this level. As this was a resistance level post-breakout, opportunities could have been taken here.

After finding resistance at $16, the stock pulled back and made a higher low. The higher low is bullish because it tells me that buyers have stepped up and are now willing to pay higher prices for the stock. Shortly after the higher low at $14.50, the stock closed the day at the highs.

From now on, there are new key levels to be aware of. If the stock will have further upside and continuation this week, I believe it needs to hold above $16. If the stock fails to hold above $16, then $14 – $14.50 is the new critical area of support. I would not like to see the stock below this area because that would signal a failed breakout, and momentum would shift.