Last week’s Friday was interesting.

The S&P 500 ETF, SPY, was up 0.76% and closed the week strong, finishing up 1.83%.

Biotechs, however, lagged, with the IBB down 0.51% on Friday and up 1.30% on the week.

With Biotechs lagging the overall market on Friday and displaying relative weakness, I was selective and relatively defensive with my biotech watch list and game plan on Friday.

When a sector or industry lags the overall market but remains an attractive sector nonetheless, I like to identify stocks showing relative strength within that sector.

Two low float biotech stocks stand out to me as they rose sharply last week and closed the week out strong. These two stocks were seemingly unaffected by the relative weakness in the industry.

So might there be a continuation in these stocks in the coming week?

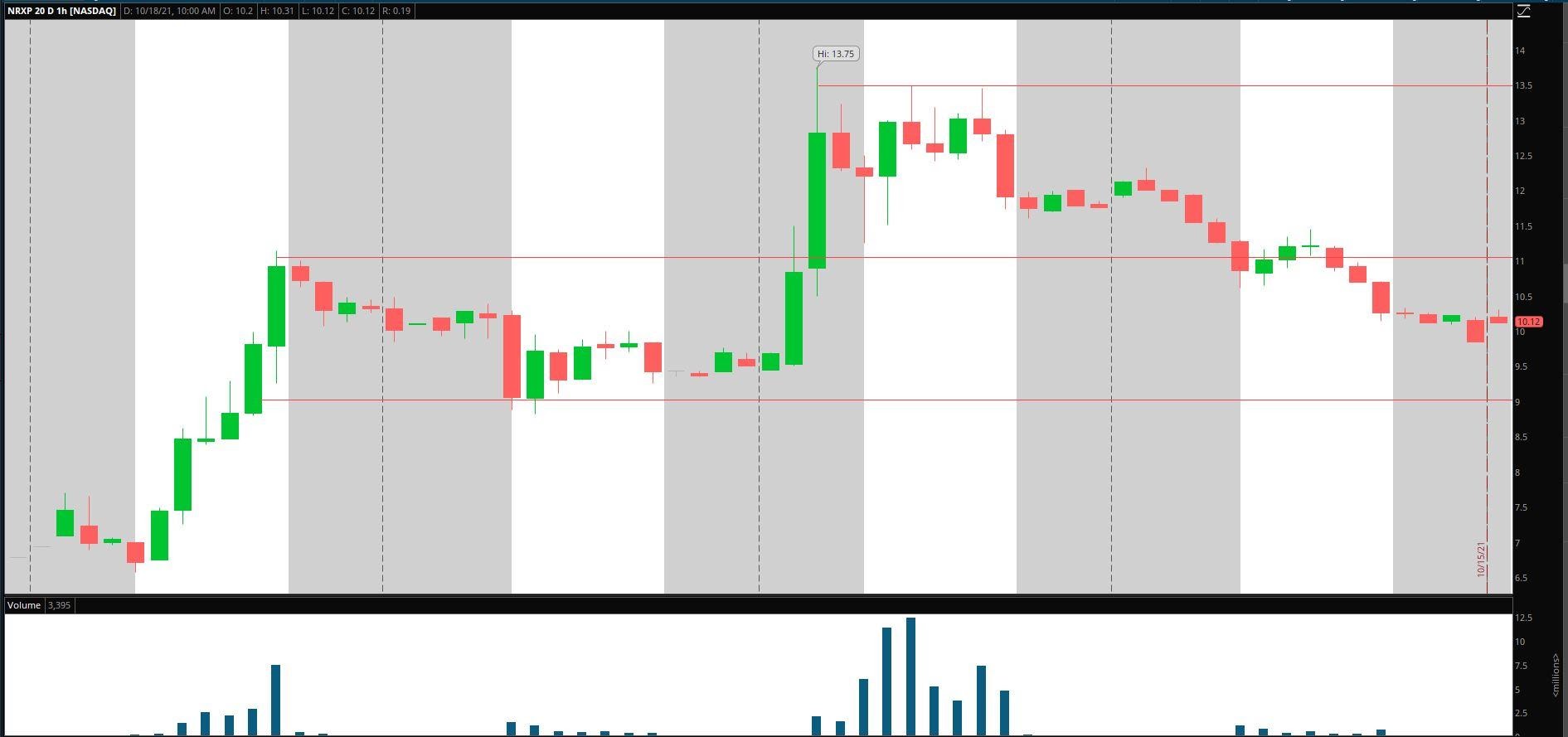

NRx Pharmaceuticals (NRXP)

NRXP closed the week up 47.63% after the stock broke out on Tuesday after announcing positive news.

The stock has been in a downward trend since the start of the year. Last week marked the first notable increase in volume that the stock had seen since July when the stock went from $11 to over $26.

NRXP, according to Yahoo, is a clinical-stage small molecule pharmaceutical company, develops various therapeutics for the treatment of central nervous system disorders and life-threatening pulmonary diseases.

Market Cap: 640.43M

Float: 18.83M

Short Interest: 9.03%

ATR: 1.43

Average Volume: 6.39M

Volume dropped off significantly on Wednesday after the stock made a significant move the previous day. The following day, the stock broke out, and volume increased.

On Friday, volume in NRXP dropped off significantly once again, and the stock drifted lower. The bulls will be hoping that history repeats itself and that volume increases today.

Three key levels stand out to me from now on. Significant support in the stock is $9. If the stock is unable to hold above this level, I will no longer have confidence in its potential to have another leg higher in the short term.

$11 is resistance from Friday and another essential level. If the stock can reclaim $11 and base above it, a higher low might be confirmed on the hourly chart, and a consolidation leading to a breakout might be forming.

The high from Thursday and critical resistance in the stock at $13.50. The stock failed multiple times to break above and hold above this level. If the stock can break over this area, I believe it might have an impressive move to the upside.

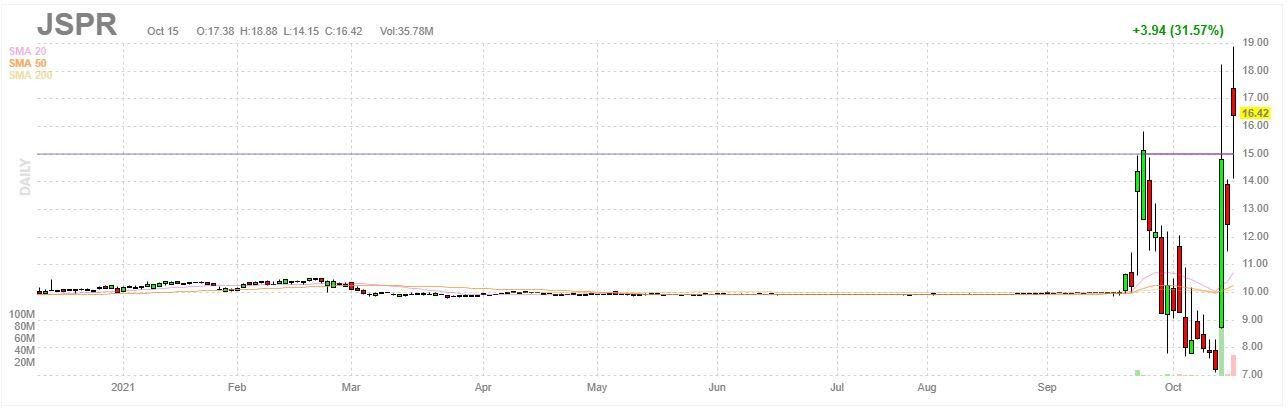

Jasper Therapeutics (JSPR)

JSPR had a week to remember. The stock closed up 106.28% on the week and up 31.57% on Friday.

The stock soared higher on Wednesday after Oppenheimer initiated coverage of the stock with an outperform rating and a $21 target.

JSPR began trading last month on Nasdaq after completing a business combination with Amplitude Healthcare Acquisition.

The stock is up over 64% on the month so far.

According to Yahoo, JSPR is a clinical-stage biotechnology company, develops therapeutic agents for hematopoietic stem cell transplantation and gene therapies.

Market Cap: 455M

Float: 2.37M

ATR: 2.59

Average Volume: 2.63M

Three levels stand out to me from the chart by taking volume and time spent at each level into consideration.

On multiple occasions throughout last week, the stock failed to hold above $18. Therefore, from now on, this level is seen as critical resistance. If the stock can break above this crucial area and hold firmly, a leg higher might be likely, especially when considering the float’s size.

$14 proved itself to be a key level of support on numerous occasions. In the future, the bulls might not want to see the stock hold below this crucial level, thereby turning it into resistance. I would view consolidation above this key area as bullish in the short-term, as long as the stock continues to make higher lows.

If the stock breaks below $12, I would no longer view this as a bullish setup. Of course, the stock would need to break below $12 and spend time below $12, confirming that the buyers are exhausted, and momentum has shifted.