1.0 Beginner: The Basics of Options

- What is an option?

- A financial tool called a derivative

- A financial tool to trade future contracts

- A financial tool to trade foreign exchange

- A financial tool called a LEAP

Answer: A

Notes:

- Options are financial tools that are called derivatives.

- Derivatives are based on the value of underlying securities, such as stocks.

- What is an option contract?

- Gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price.

- Gives an investor the obligation to buy or sell a stock at an agreed upon price.

- Gives an investor the right, but not the obligation, to buy or sell a stock at any price.

- Gives an investor the obligation to buy or sell a stock at any price.

Answer: A

Notes: A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price.

- What is a call option?

- Call options offer the writer the opportunity to buy the underlying asset at the strike price.

- Call options offer the writer the opportunity to sell the underlying asset at the current market price.

- Call options offer the buyer the opportunity to buy the underlying asset at the strike price.

- Call options offers the buyer the opportunity to sell the underlying asset at the current market price.

Answer : C

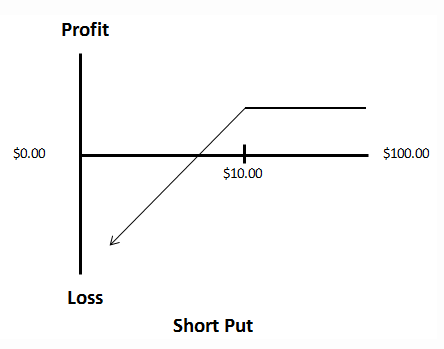

- What is a put option?

- Put options offer the writer the opportunity to sell the underlying asset at the strike price.

- Put options offer the buyer the opportunity to sell the underlying asset at the strike price.

- Put options offer the buyer the opportunity to buy the underlying asset at the current market price..

- Put options offer the writer the opportunity to buy the underlying asset at the current market price.

Answer: B

- What are weekly contracts?

- Options contracts that expire on every second Friday of the month.

- Options contracts that expire on every third Thursday of the month.

- Options contracts that expire on Friday of every week.

- Options contracts that expire on Saturday of every week.

Answer : C

- What are standard monthly contracts?

- Options contracts that are issued with 9 month expirations and expire on the Saturday following the 3rd Friday of every month at 11:59pm EST.

- Options contracts that are issued with 12 month expirations and expire on the Sunday following the 2nd Friday of every month at 11:50pm EST.

- Options contracts that are issued with 6 month expirations and expire on the Friday following the 2nd Friday of every month at 11:59 EST.

- Options contracts that are issued with 9 months of expiration and expire on the Saturday of the 2nd Friday of every month at 11:59pm EST.

Answer: A

- What does the OCC stand for?

- Options Clearing Company

- Options Clearing Committee

- Options Conference Committee

- Options Concile Company

Answer : B

- What are Listed Stock Options?

- Listed Options are futures options that are a put or call that is traded on a national options exchange, and have a fixed strike price and a fixed expiration date.

- Listed Options are a put or call that is traded on a national options exchange, and have variable strike prices and fixed expiration dates

- Listed Options are a put or call that is traded on a regional options exchange only, and have variable strike prices and variable expiration dates.

- Listen Options are a put or call that is traded on a national options exchange, and have a fixed strike price and a fixed expiration date.

Answer : D

- What is the underlying security for stock options?

- The stock that can be purchased or sold upon exercise of options contracts

- The future that can be purchased or sold upon exercise of options contracts

- The stock that can be purchased or sold without exercise of options contracts

- The future that can be purchased or sold without exercise of options contracts

Answer : A

- What does it mean to exercise an option?

- To implement the right for the option holder to buy (for a call) or sell (for a put) the underlying security at the market price.

- To implement the right for the option holder to sell (for a call) or buy (for a put) the underlying security at the listed strike price.

- To implement the right for the option seller to sell (for a call) or buy (for a put) the underlying security at the listed strike price.

- To implement the right for the option holder to buy (for a call) or sell (for a put) the underlying security at the listed strike price.

Answer : D

Notes:

- Options are typically exercised when they are in the money.

- When do listed equity options settle?

- Settle “non-regular way”, or two business days from the expiration date

- Settle “regular way”, or four business days from the expiration date

- Settle “regular way”, or three business days from the expiration date

- Settle “non-regular way”, or four business days from the expiration date

Answer : C

- What is the strike price of an option?

- The price at which the holder of an option can buy (for a call) or sell (for a put) the underlying security when the option is exercised.

- The price at which the seller of an option can sell (for a call) or buy (for a put) the underlying security when the option is exercised.

- The price at which the holder of an option can buy (for a call) or sell (for a put) the underlying security before the option is exercised.

- The price at which the seller of an option can buy (for a call) or sell (for a put) the underlying security before the option is exercised.

Answer : A

- How is options premium calculated?

- Option Premium = Intrinsic Value + Extrinsic Value

- Option Premium = Intrinsic Value – Extrinsic Value

- Option Premium = Intrinsic Value + Extrinsic Value + Strike Price

- Option Premium = Intrinsic Value – Extrinsic Value + Strike Price

Answer : A

- How is Intrinsic Value calculated?

- Difference between the strike price and market price of the underlying security.

- Difference between the market price and the current option price

- Difference between the current option price and At-the-Money (ATM) option price

- Difference between the At-The-Money (ATM) option price and the market price of the underlying security

Answer: A

Notes: Intrinsic Value = Strike Price – Market Price of security

- How is Extrinsic Value calculated?

- The sum of the strike price of an option and the intrinsic price minus the market price, also known as its premium.

- The difference between the market price of an option, also known as its premium, and its intrinsic price.

- The difference between the market price of an option, also known as its premium, and its strike price.

- The difference between the strike price of an option and the intrinsic price plus premium

Answer: B

Notes:

- Extrinsic Value = premium – intrinsic price

- Extrinsic Value is also known as time value

- What are the types of options?

- Calls and Puts

- Strikes and Market price

- Calls only

- Puts only

Answer : A

- What is an options class?

- Every Call or every Put of an underlying stock, regardless of expiration month and strike price.

- Every Call or every Put of an underlying stock, in the same expiration month and same strike price.

- Every Call of an underlying stock, regardless of expiration month and strike price.

- Every Put of an underlying stock, regardless of expiration month and strike price.

Answer : A

- What is an option expiration?

- The day after the final date on which the derivatives contract is valid

- The final date on which the derivatives contract is valid

- The day prior the final date on which the derivatives contract is valid

- Two days prior the final date on which the derivatives contract is valid

Answer : B

Notes:

- All contracts have a specified life cycle and expire on a specific date.

- What does Out of the Money (OTM) of a call refer to?

- call is “Out-of-the-Money” (OTM) when the market price is higher than strike price.

- A call is “Out-of-the-Money” (OTM) when it has only intrinsic value and no extrinsic value.

- A call is “Out-of-the-Money” (OTM) when the market price is equal to the strike price.

- A call is “Out-of-the-Money” (OTM) when the market price is lower than strike price.

Answer : D

- What does Out-of-the-Money (OTM) of a put refer to?

- A put is “Out-of-the-Money” (OTM) when it has only intrinsic value and no extrinsic value.

- A put is “Out-of-the-Money” (OTM) when the market price is equal to the strike price.

- A put is “Out-of-the-Money” (OTM) when the market price is higher than the strike price.

- A put is “Out-of-the-Money” (OTM) when the market price is lower than the strike price.

Answer : C

- What does In The Money (ITM) of a call refer to?

- A call is “in the money” when the market price is lower than the strike price.

- A call is “in the money” when the market price is higher than the strike price.

- A call is “in the money” when the market price is equal to the strike price.

- A call is “in the money” when the option possesses extrinsic value and no intrinsic value.

Answer : B

Notes:

- A call option is in the money (ITM) if the market price is above the strike price.

- ITM options only possess intrinsic value, and no extrinsic value

- What does In The Money (ITM) of a put refer to?

- A put is “in the money” when the market price is lower than the strike price.

- A put is “in the money” when the market price is higher than the strike price.

- A put is “in the money” when the market price is equal to the strike price.

- A put is “in the money” when the option possesses extrinsic value and no intrinsic value.

Answer : A

Notes:

- A put option is in the money if the market price is below the strike price.

- ITM options only possess intrinsic value, and no extrinsic value

- What does At The Money (ATM) refer to?

- When an option’s strike price is less than the market price of the underlying security.

- When an option’s strike price is greater than the market price of the underlying security.

- When an option’s strike price is equal to the market price of the underlying security.

- When the market price of the underlying security is equal to the option’s strike price plus breakeven price

Answer : C

- How do you calculate the breakeven price of a long call?

- Breakeven = Strike Price + Market Price

- Breakeven = Cost – Strike Price

- Breakeven = Cost + Strike Price

- Breakeven = Strike Price – Market Price

Answer : C

- How do you calculate the breakeven price of a long put?

- Breakeven = Strike Price + Market Price

- Breakeven = Cost – Strike Price

- Breakeven = Cost + Strike Price

- Breakeven = Strike Price – Market Price

Answer : B

- How do you calculate the breakeven price of a covered call?

- Breakeven = call option premium – market price of stock at initiation

- Breakeven = call option premium + market price of stock at initiation

- Breakeven = call option premium – current market price

- Breakeven = call option premium – strike price

Answer : A

- How do you calculate the breakeven price of a protective put?

- Breakeven = current price of stock – premium paid

- Breakeven = purchase price of stock – premium paid

- Breakeven = current price of stock + premium paid

- Breakeven = purchase price of stock + premium paid

Answer : D

- What are the 4 factors that impact options premium?

- implied volatility, intrinsic value, time remaining until expiration

- historical volatility, intrinsic value, time remaining until expiration

- implied volatility, intrinsic value, time remaining until expiration, interest rates

- historical volatility, extrinsic value, time remaining until expiration, interest rates

Answer : C

- What is Implied Volatility?

- IV is a metric that captures the market’s view of the likelihood of changes in a given security’s price

- IV is a metric that captures the market’s view of the likelihood of a change in a given security’s delta

- IV is a metric that captures the market’s view of the likelihood of a change in a given security’s time value

- IV is a metric that captures the market’s view of the likelihood of a change in a given security’s historical volatility

Answer : A

- What are the 5 common options greeks?

- Delta, Gamma, Theta, Vega, Rho

- Vomma, Volta, Surge, Speed, Delta

- Delta, Theta, Rho, Volga, Vomma

- Gamma, Delta, Vola, Volga, Theta

Answer : A

Notes: Option greeks us a term used to describe the different dimensions of risk involved in taking an options position

- What does the greek, Delta, represent?

- Represents the rate of change between the options price and $4 change in the underlying asset’s price.

- Represents the rate of change between the theta and $3 change in the underlying asset’s price.

- Represents the rate of change between the gamma and $2 change in the underlying asset’s price.

- Represents the rate of change between the options price and $1 change in the underlying asset’s price.

Answer : D

Notes: Calls have a positive delta, between 0 and 1. Puts have a negative delta, between 0 and -1

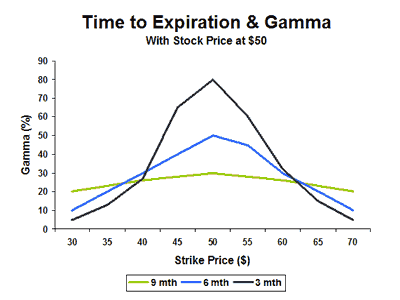

- What does the greek, Gamma, represent?

- Represents the rate of change between the options theta and the underlying asset price.

- Represents the rate of change between the options delta and the underlying asset price

- Represents the rate of change between the options vega and the underlying asset price.

- Represents the rate of change between the options rho and the underlying asset price.

Answer : B

Notes:

- Second order derivative

- Indicates the amount the delta would change given a $1 move in underlying asset’s price

- What does the greek, Theta, represent?

- Represents the rate of change between the options price and historical volatility, or options volatility sensitivity

- Represents the rate of change between the options implied volatility and time, or options vomma sensitivity

- Represents the rate of change between the options price and time, or options time sensitivity

- Represents the rate of change between the options price and delta, or options dollar sensitivity

Answer : C

Notes:

- Also known as option’s time decay

- Theta increases when options are At the money

- Theta decreases when options are In the money or Out-of-the-money

- As options near expiration, Theta will increase significantly

- What does the greek, Vega, represent?

- Represents the rate of change between the underlying market price and implied volatility.

- Represents the rate of change between an option’s value and the underlying assets implied volatility.

- Represents the rate of change between the option’s delta and the underlying assets implied volatility.

- Represents the rate of change between the option’s time value theta and the underlying assets implied volatility.

Answer : B

Notes:

- Known as the option’s sensitivity to volatility

- Vega indicates the amount the options price will change given a 1% change in implied volatility

- What does the greek, Rho, represent?

- Represents the rate of change between an option’s value and a 2% change in market price.

- Represents the rate of change between an option’s value and a 3% change in delta.

- Represents the rate of change between an option’s value and a 4% change in volatility.

- Represents the rate of change between an option’s value and a 1% change in interest rates.

Answer : D

Notes:

- This measures the sensitivity to interest rates.

- When are Weekly options contracts issued?

- Issued Wednesday and expire the following Thursday

- Issued Tuesday and expire the following Wednesday

- Issued Friday and expire the following Thursday

- Issued Thursday and expire the following Friday

Answer : D