While penny stocks, in general, get a bad rap…if they are traded on the “over-the-counter” (OTC) market, it’s even worse.

Some traders are downright afraid of them. They’ve heard the stories of volatility and people losing their shirts trying to find the “next big thing.”

However, from my experience, most of that fear comes from a lack of knowledge.

And while it’s not for everyone, there’s no need to be afraid of these stocks.

So I’m going to shed some light on the subject and let you decide whether it’s something that makes sense for you.

NYSE pennies vs. OTC pennies

The SEC considers any stock trading under $5 per share to be a penny stock. You can find penny stocks on the NYSE and the NASDAQ, but most are traded through the over the counter (OTC) exchanges.

The major exchanges like the NYSE and the NASDAQ have minimum requirements for stock prices, total market capitalization, and disclosure by the companies they list…

Many of the smaller companies that can’t meet these requirements, but still need to raise capital, do so through the OTC markets, where they don’t need a large market capitalization and don’t have to meet the higher level or reporting requirements.

Due to these differences, the OTC exchanges get the bad rap. But there is a lot of misunderstanding when it comes to this.

And with the majority of the penny stocks being traded on the OTC exchanges…there are a lot of opportunities there.

OTC’s Bad Rep

Penny stocks are notoriously hard to value, especially on the OTC exchanges.

Since reporting requirements for the OTC markets aren’t as stringent as NYSE or Nasdaq, you simply won’t have the same transparency as companies listed on the major exchanges.

Penny stocks are generally “valued” based on their potential rather than their financials. These are companies that are generally in the early stages of development, so their value is in what they can achieve in the future.

That doesn’t help us much right now because, without much of an established business, these are the riskiest of investments.

And the companies that are long established haven’t grown enough to get uplisted to a major exchange, so they aren’t going to get any excitement from investors.

So how do you value a company without an abundance of reliable financial information?

Well, you don’t. Not from an investment standpoint at least. That’s why I don’t invest in penny stocks.

I trade them.

Low Price, Amplified Move

My strategy with penny stocks is not to buy and hold, it’s to trade them for the short term movements.

These stocks make very large percentage moves relative to higher priced stocks.

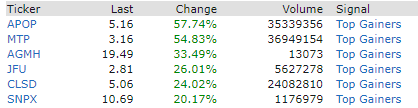

Just look at some of the top gainers from this morning…

As you can see, these are mostly in the penny stock price range.

Think about it…a $1,000 stock has to move $100 for 10%.

A $1 stock only has to move .10 for the same 10%…so it’s not surprising you’ll find the biggest percentage movers in lower priced stocks.

And this provides some great opportunities for trading.

Penny stocks are some of the most volatile stocks in the market, providing large moves in short time frames.

While volatility in the general market makes for a lot of uncertainty with your investing, volatility in penny stocks is the name of the game.

It’s all about reading the charts for short term trades.

However…the volatility goes both ways.

While most of the biggest gainers are in the penny stock range, so are the losers.

And that’s exactly why I’m not looking to hold them long.

I try to keep it simple for myself… I have a few specific patterns I’m generally looking for and pair those with volume and a few other indicators.

Chart Patterns for Penny Stocks

Penny stocks might be hard to value… but I find opportunities in the OTC markets and penny stocks by looking at the charts and by trading short term.

Luckily I have a few posts you can check out to learn about my favorite charts patterns to trade.

3 Comments

What about liquidity and the spread between bid/ask?

Thank you for that information

Thanks for the education.