When it comes to trading…there are often multiple setups on a single chart.

But that doesn’t mean I need to catch ‘em all.

I’ve been trading long enough to know it’s just not possible to catch every potential trade…so I don’t worry about missing them.

Getting caught up in what could have been is a good way to get beat up by the market.

Instead, I focus on what’s in front of me.

However, I look back at previous moves to help paint a picture of support and resistance levels, etc…

I’m going to walk you through a trade in Dark Pulse Inc. (DPLS) that I entered on Friday and exited this morning.

You’ll get to see a clear consolidation breakout trade that I previously missed out on…along with the trade I did catch.

If I let myself get caught up on a missed trade, there’s a good chance I’ll miss the next trade as well…

It’s important to remember another trade will come along…don’t get emotional, don’t chase, and don’t get stuck in the past.

I’ll walk you through it…and you’ll get a good look at some of my personal favorite chart setups along the way.

Dark Pulse Inc. (DPLS)

DarkPulse, Inc. (DPLS) is a technology company that focuses on developing, marketing, and distributing a suite of engineering, installation, and security management solutions to mine safety, oil & gas, pipeline and border security.

The company develops patented BOTDA dark-pulse sensor technology that allows a data stream of critical metrics for assessing the health and security of clients’ infrastructure.

Looking at the daily chart below…

After a move up to .051, the stock entered a consolidation range from .01 – .02 on lower volume.

After about 2 months in that range, the stock stepped up to consolidate between .017 and .0246 while volume got even lighter.

DPLS traded in that range for another month before releasing news of intent to acquire two drone based A.I. companies on June 8.

https://ir.darkpulse.com/news-events/press-releases/

And that’s when it all happened… The RSI rose above 50 and volume increased significantly on the breakout move leading to a surge in the stock price, which reached new highs.

This was a classic consolidation breakout, which I missed. It just wasn’t on my radar at the time…it happens. And it’s nothing to feel bad about. Trades come and go, it’s all part of the game.

You can learn the ins and outs of the consolidation breakout right here…

Well you know what they say?! What goes up must come down…

A few days ago DPLS pulled back to test the previous closing high around .04 and held above it.

When a stock breaks a resistance level, I then look for it to become support for a potential new move up, and in this case, it holds with the highs/ resistance on the move up in February turning into support on the recent breakout.

With this new support level to work with, I was eyeing a trade here. I just needed to make sure it held first.

And the very next morning DPLS opens higher and starts its next move up from the previous resistance level turned support (seen in the chart below).

This move offered me a good entry with support just below.

DPLS then made a new move up from here…potentially on it’s way to a stair-step pattern, which you can learn all about right here…

My entry happened last Friday when the stock continued to show strength.

This was an end-of-day entry on a Friday and exit Monday morning on the pent-up demand over the weekend…

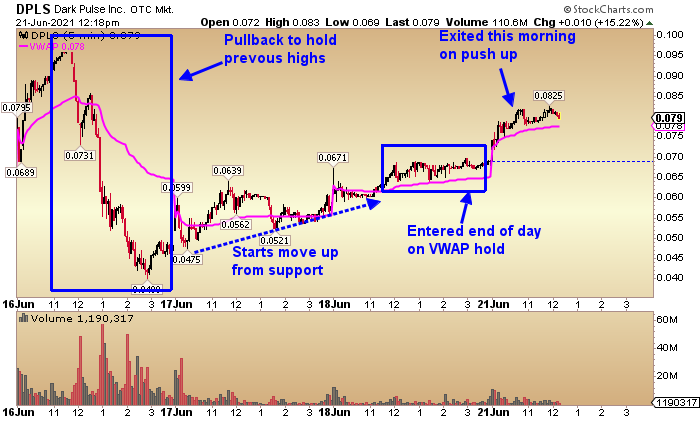

Being such a short-term trade, looking at the 5 min intraday chart below gives a better picture of what I was eyeing…

After the pullback to create a new support level, and the move up from there…

I was watching on Friday afternoon as DPLS held above the VWAP (pink line in chart).

Holding above VWAP shows strength… Click here to find out how I use VWAP in my trading…

I entered DPLS Friday afternoon… and this morning, I was able to exit on the move up from pent-up demand over the weekend.

While I missed that consolidation breakout earlier this month… I didn’t let it affect me, and ultimately I was ready when another potential trade set up off the pullback to support.

I miss trades all the time, it’s no big deal.

It’s better to miss a good trade than to force a bad one. That’s why I don’t try to catch ‘em all.

I don’t want to end up over-trading or forcing trades, neither of which ends well.

So instead, I just stick to my plans and trade accordingly. That’s all I can control.

1 Comments

I notice dpls was extremely expensive in 1995 off and on through the early 2000. Is this just a pump and dump? The early history makes it look suspicious as if the ceo wants to generate more capital. How does this work?