Trading momentum is a great strategy in a bull market when stocks continue higher and higher. Tesla (TSLA) is a great example of this when it is ripping the faces off short-sellers.

But what do you do when stocks begin to consolidate and trade sideways?

Trying to apply momentum strategies to a range-bound stock can lead to a trader getting chopped up as a stock fails to go higher and, at the same time, fails to go lower. There is, however, another way to trade this type of price action and get better results. It’s an options strategy known as an Iron Condor that directly benefits from a stock staying range-bound, and I have placed such a trade in Facebook (FB).

FB is trading inside a range, as the buyers stepped in and bought the stock after a 20% pullback from the highs made in September. The bulls have defended the $305 level on two occasions now since September, and that is now a significant area of support.

However, the $350 has also become a major level of resistance.

It was a nice support level back in August 2021, but FB has since failed there twice, in November, before finding support at $305 and once again near the end of December, where it failed at the $350 area once again. FB is now trading at around $324 in the middle of this range.

Daily Chart of FB showing Major Support at $305 and Resistance at $350

I’m thinking that as the buyers step in, the sellers will be right there waiting and vice versa. FB could be stuck inside this range for a long time to come before it decides to move either higher or lower outside this range for a significant move in either direction.

So how can I trade this type of price action? The trade setup is called an Iron Condor, and it allows the trader to collect on the collapse of Implied volatility and also benefit from the passage of Time (Theta).

Trading Lesson – Iron Condors:

Iron Condors are used for two primary purposes; to take advantage of a range-bound stock and to trade high levels of Implied Volatility (IV) in expectation of a drop in IV in the future.

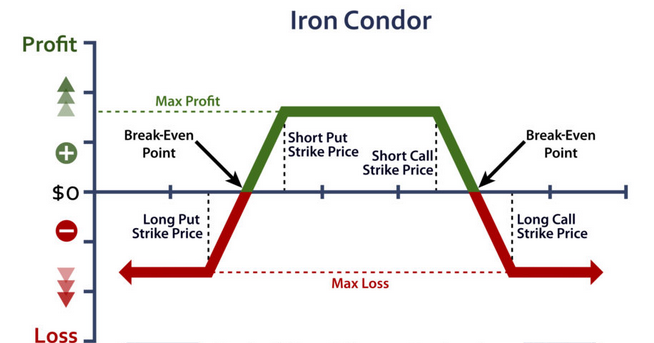

What does an Iron Condor look like?

The Trade

It works like this. I sell puts closer to the stock price, but at a price, I don’t think FB will go below. In this case, I have sold the $310 puts. However, to protect myself from catastrophic loss if the price of FB collapses, I buy the $305 puts, which will hedge the $310’s I sold but will be slightly cheap as they are further out of the money. Then I do the same thing above the range but with calls.

So, in this case, I have sold the $355 calls, which are more expensive, and I have hedged this position by buying the $360 calls. This way if FB stays within the range of $310 and $355, as I expect it to do, I will collect the full premium on this Iron-Condor. Moreover, my risk is defined, in case it breaks out of this range.

There are 4 main areas to be concerned with when trading Iron Condors:

- As a stock stays range-bound between the short put and short call strikes, you will receive a max profit on the trade.

- If the stock starts the fall outside of those zones, you will see slightly lower profits up until the break-even point.

- If the stock is above or below the long put and call price, you will receive a max loss on this trade

- If the stock is beyond the break-even point and the long put or call price, you will receive a slightly less loss on this trade

As time passes, if FB stays range-bound, the value of these 2 spreads I have sold will fall due to a fall in IV and passage of time (Theta), and thus by being a seller of the spreads, my position stands to gain.

Bottom Line

Stocks typically go through 2 phases, trending and consolidating. Applying momentum strategies works well in the trending phase but not so much in the consolidation phase.

However, there is a strategy that generally works much better when a stock is consolidating. That strategy is known as an Iron-Condor. This trade benefits from a fall in intrinsic value (IV) and from the passage of Time (Theta). By selling 2 spreads, a bull put and a bear call spread, a trader is able to benefit from a range-bound market or stock.

I have put on an Iron-Condor in FB as it is consolidating between $300 and $350. So long as this range continues and FB stays above $310, and below $355, I will have a great trade on my hands. As the great Jessie Livermore once said, “There is only one side of the market, and it is not the bull side or the bear side, but the right side.”

2 Comments

How far out is your trade for Jeff before you collect if it stays in the range?

So you buy to open 355 call Feb?, and sell to close the 305 Put. Correct,to perform the iron condor?

Hi,.i use to buy only calls and puts not use to this kind of trades kind of little scary