I’ve been bearish on Bitcoin in the short term for a little while now. I’ve been waiting for a bounce to take a position, but it hasn’t happened. Now I’m even more Bearish. But I’m not just going to naked short Bitcoin, that’s way too risky for my liking, and I’m looking to structure this trade idea another way!

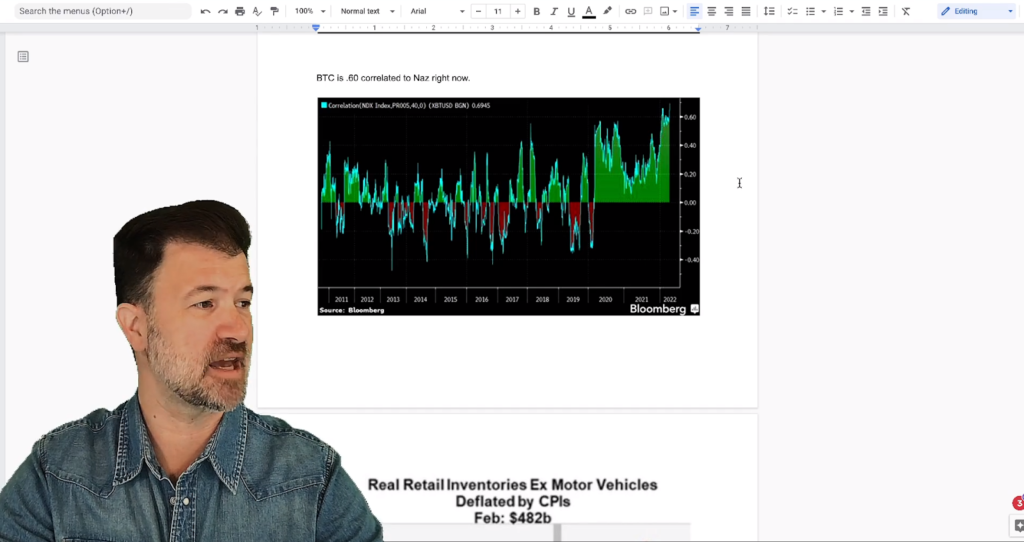

The Nasdaq correlation right now to Bitcoin is almost as high as it’s ever been at 60%.

Chart showing Bitcoin correlation at 0.6 to the Nasdaq

That means they follow each other closely. Not 1 to 1 where they would move identically, but 0.6 to 1, which is pretty close. That’s something to keep in mind in that Bitcoin is trading like a tech stock, and tech stocks are in a Bear market!

I’m pretty bearish on crypto right now. Bitcoin couldn’t hold above 45,000 and is now consolidating around the 40k level. A break below this level could see a massive stop run and fast drop!

Here’s what might happen:

I definitely think we could see a test of the lows seen back in February at around 35k.

If I was going to short Bitcoin, which I am going to, I would do it by shorting MSTR using options.

MicroStrategy (MSTR), As Of Apr. 4, 2022, Co. Held ~129,218 Bitcoins With Average Purchase Price Of ~$30.7K/Bitcoin valuing their holding at approximately $5, 168, 720, 000 at a BTC price of $40k.

I’ve been waiting for a bigger bounce to short MSTR for a long time now and it just isn’t bouncing. I’ve been saying I’m going to short it for ages and it’s finally time!

I’ve decided to take a starter position, i.e., a trade with small size, and I will slowly add to it.

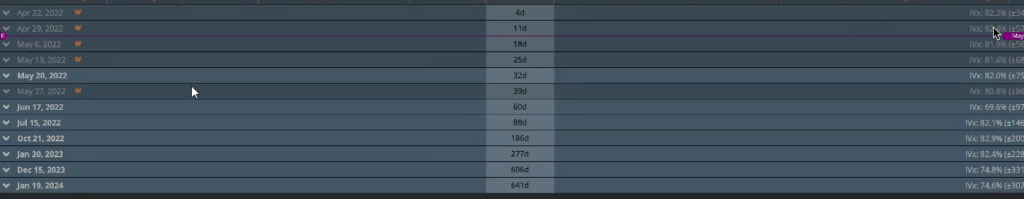

The implied volatility on MSTR is very high. This means that the options are more expensive than usual.

As you can see, the implied volatility is over 80%, and to me, that’s a lot!

Thus to take a short position, rather than buying puts outright because they are expensive, I think the best way to structure this trade is to sell a call spread. I don’t think Bitcoin will rocket any time soon and thus will sell out of the money call spreads.

I’m looking at the May 6 call spreads, 3 weeks out. I’m looking to sell the 460 calls and buy the 465 calls at $1.90. So long at MSTR stays below 460 I will pocket this premium.

Note: I tried to take this trade live in Master’s Club Yesterday, but my TastyWorks broker wasn’t accepting orders on MSTR. I will be looking to make this trade in my TD Ameritrade account today instead. Given the bounce in BTC, I should be able to get an even better price for the spread today than yesterday! In fact, I might just go farther OTM (out of the money) on the trade instead, that is sell the 470, 475 call spread for example. Subscribers will be alerted when I’ve made the trade!

Key Takeaway

By selling a call spread, I don’t even need MSTR or Bitcoin to fall in order to make a good trade if it does great. So long as MSTR stays sideways or even goes up a little, my trade will work. By selling out of the money calls, I increase the probability of my trade idea working but give up potential profit as a result!