The market has done nothing but go up since the early part of October, as it has been anticipating the arrival of the Saint. Nick (i.e., the Santa Claus rally).

Given how extended the market has become as a result, I’ve been looking for the market to pull back.

Not a lot, not a crash, but certainly something that resembles the 3% corrections that have become so commonplace since the COVID crisis lows.

To reflect this opinion, this week I placed a type of trade that is extremely rare for me.

Let’s take a closer look at it…

This week is thick with earnings reports.

Now, I’ve taken a few hits on earnings lately, so I am shriveling up when it comes to taking positions ahead of these events.

Instead, I decided to focus some attention on shorting the market for a quick trade.

Specifically, I bought the Nov 19 $400 Puts in QQQ (the Invesco Nasdaq 100 Trust).

Sure, I trade a lot of Puts, however, they’re usually part of an options spread strategy like a Vertical Credit Put Spread, not a 1-leg Put purchase.

Since I rarely buy straight Puts, I wanted to take this opportunity to educate you on the basics of this trade, and to help you understand why I chose a contract that is in the money.

Put option basics

When you buy a Put option, you want the price of the underlying stock to move lower.

By buying the Put, a trader is given the right, but not the obligation, to sell the underlying stock (or ETF) at a specific price by a specific date.

This differs from buying a Call option which, where you want the price of the underlying stock to rise.

By buying the Call, a trader is given the right, but not the obligation, to buy the underlying stock (or ETF) at a specific price by a specific date.

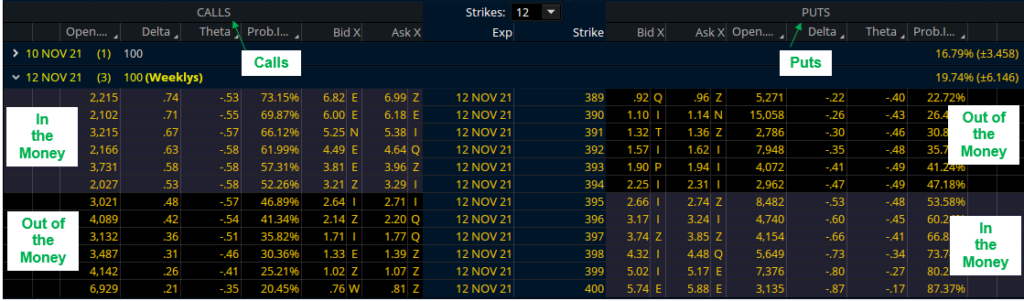

When we look at an options chain, no matter which trading platform you’re using, the Put contracts are always going to be on the right-hand side as shown below.

Also shown below is the location of the “in the money” (ITM) and “out of the money” (OTM) options.

Specifically, for Calls, the ITM options are always in the top left of the table in the shaded area, while the OTM options are located in the bottom left of the table.

Then, for the Put options, this is reversed, with the ITM options located in the bottom right of the table in the shaded area, while the OTM options are located in the top right of the table.

But it’s important to understand the difference between the ITM options and the OTM options, and why I chose to go with an ITM option.

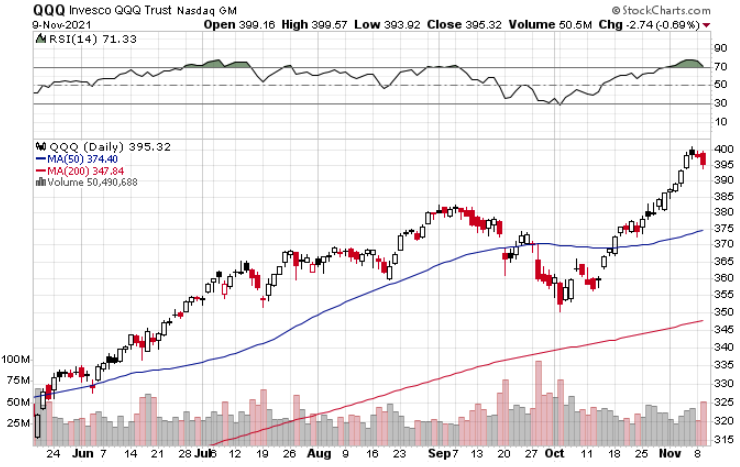

As I mentioned earlier, the market has just gone straight up in recent weeks.

This next chart shows exactly what I mean, with the RSI momentum indicator reaching 80 just prior to this week’s pullback. Now that’s an extreme reading.

Every time there’s a little bit of a pullback, new buyers just keep coming in, and that combined with bears getting squeezed out of freshly made short bets has fueled the market’s aggressive rise.

Now, other than the fact that I just think the market has become too stretched to continue without a little bit of a pullback (as a reminder, I am just looking for a 3% correction), I really don’t see any reason to believe the market is going to crash.

Based on my respect for the power of the buying interest that remains in this market, I want to play the Puts trade the safest way possible, which is by buying ITM Puts.

So what is an ITM Put and why is it the safer bet here?

ITM options are options that have intrinsic value.

Intrinsic Value is the inherent value of an option. It’s calculated by subtracting the strike price from the current price of the underlying security.

ITM Puts have a strike price that is higher than the current market value.

ITM Put options mean the option holder can sell the security above its current market price.

This compares to OTM Put options, which have a strike price that is lower than the current market value of the underlying security.

ITM options are more expensive than other options since investors pay for the profit already associated with the contract.

The buyer of a Put option hopes the stock’s price will fall far enough below the option’s strike to at least cover the higher cost of the premium for buying the Put.

This brings me to why I decided to pay up for the ITM $400 Puts, and that reason is the market’s recent strength, which means there is a relatively high risk the market can rise against my bearish bet.

In other words, ITM Puts already have built-in profit, which means they do not need to move as far as OTM puts.

And since ITM options move more closely with the underlying price (ITM calls have high positive Deltas, ITM Puts have high negative Deltas), they are more likely to gain in value if the market moves lower.

This compares to OTM Puts that have weak to low negative Deltas, and require the underlying to move a significant distance in order for the value to change.

Delta is expressed in percentage terms, and the options that I purchased for this trade currently trade with a Delta of around 80.

A 80 Delta means that an option’s premium will increase or decrease by 0.80 times a $1.00 move (up or down) in the price of the underlying stock.

In other words, an option with a 80 Delta will move by $0.80 for every one dollar move in the underlying stock.

The bigger the Delta, the more the option will move like a stock.

Bottom Line

There will be times throughout your trading career when you see a trend that you know in your gut has simply gone too far and needs to revert toward the mean (i.e., it needs to correct back to the average).

In today’s example, my bet against the market’s strong uptrend means the potential for a failed trade is elevated.

3 Comments

yup — I bought a couple of $389 11/29 puts on 11/08. Paid ~~$700. Now worth ~~$1240. Delta of -.48.

When I’m trying to decide what denomination of option to buy, my eye goes up the column, & I say to myself “I can buy an additional $1 of strike value by paying an additional ____ of premium, [fill in the blank, but it is ALways less than $1 — sometimes around $.50]

TDA/TOS will not let anyone do a “TrailingStopLoss” on a put, so I hafta watch closely.

But I can’t figure out how to get TOS option chain to display the Delta [until AFTER I buy, when it appears in my TDA “positions” chart [I had to set that up myself]

Not sure about TOS but it is possible in the TDA platform. Once you are in the trade screen you need to hit full option list then select your series and then once that pops up, there will be a symbol next to Call and another next to Puts and if you click on that it will display all the Greeks

Thanks, Jeff! You are always so clear in your descriptions and definitions. I really appreciate that. Thanks! KD