If you’ve been following me for a while, you would know I closely observe the options market. I do this for several reasons.

I use options strategies to control and manage my risk on a particular trading setup, and I also want to know what the smart money is doing.

Market makers, the guys who provide most of the liquidity in the options market by sitting on the bid and offer are like the house in the casino. And most of the time the house wins because the odds are in their favor.

There are some folks who are often called the “smart” money— and as an active trader, I want to know what smart money is doing—to stay competitive in the market.

Today I’m going to teach you a lesson on “max pain.”

Don’t worry…this won’t hurt a bit…it’s all about a specific phenomenon which occurs on options expiration day. And how it can be used to make more informed trading decisions.

Open Interest in the Options Chain

Open interest is the total amount of outstanding options contracts which are not settled yet.

I look at the open interest at various strike prices to gauge how market participants are positioned and what the smart money is likely to do.

For example, I have been watching GAMESTOP CORP (GME) very closely over several weeks. Last Friday, I noticed that 10,000 put contracts sold at $200 and $190.

Comparatively, there were hardly any put or call contracts between $200 and $210.

There were a lot of call contracts sold at 220 and higher.

So let’s think about this from the market maker’s perspective. Meme mania has brought in a lot of speculation into stocks like GME. They have sold a bunch of puts below $200 and a bunch of calls at $220 and presumably to many retail gamblers with all due respect.

Thus the smart money has every incentive to pin the stock above $200 and below $220.

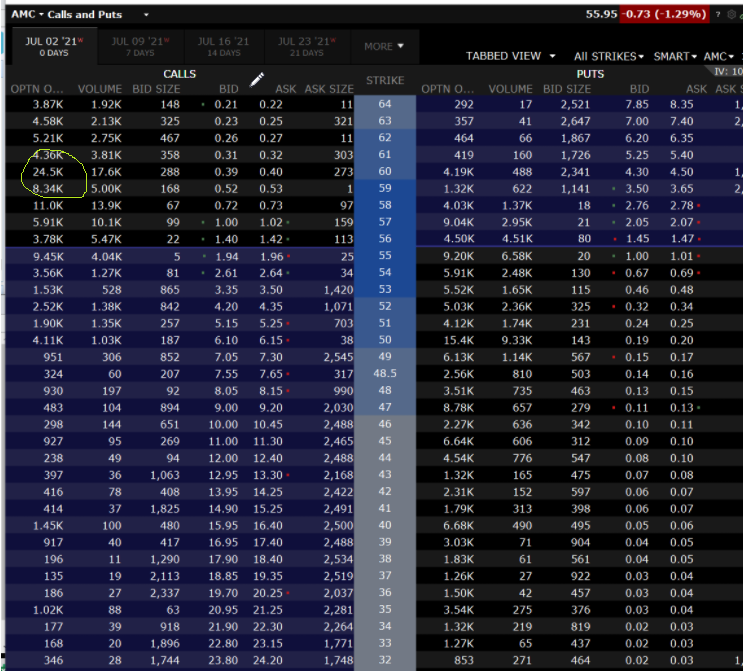

An example of an options chain. This is for AMC calls expiring tomorrow July 02 21. Notice the Open interest of 24.5K at $60 calls. The open interest here is far higher than at any other strike. Market Makers who sold these calls will likely try to keep the price below $60 to collect the premium.

Now let’s examine the chart of GME coming into the end of the week on Friday.

Gme has been in a sideways consolidation for the last few weeks

Gamestop’s Personality

If we look at the daily chart, we can see GME consolidating between $200 and $230 for the past few weeks. It contrasts with the Gamma Squeeze in weeks prior, which we will discuss another time.

We can see that the stock is calming down, and the smart money has taken control of the stock for the moment instead of the Gamma Squeeze momentum where they are forced to buy stock to hedge their call selling.

That’s why I expected GME to close somewhere between $200 and $220.

Again, it’s where most of the puts and calls respectively had been sold.

It is in the market maker’s interest to close the stock in between these levels and take all the premium from all the put and call buyers betting on a breakout one way or another.

I sold vertical put spreads in the previous days, noticing sideways action and similar open interest bets. That is, I sold the more expensive $200 puts expiring on Friday and bought the cheaper $190 puts expiring on Friday.

This reduced my downside risk just in case there was unexpected news and the stock crashed. But if the stock traded as I expected, I would pocket the difference in premium.

I had covered these before Friday as I rarely hold a spread into expiration. Usually, I cover them when I get around 50% of the maximum potential from the days prior.

The Friday Options Expiration Play in GME

Having been successful in trading the spreads, I was now preparing to trade the Friday bounce.

And because I was highly confident, I did it by buying $200 outright calls, something I do when I have high conviction in a trade. Not only that, but I was double my usual size.

This is how GME played out on the Friday:

GME trades to and slightly below $200 before rocketing the last 10minutes to $210

We see that GME traded down for most of the day towards the $200 level and held there for almost 2 hours from 1:50pm onwards. Now coming into the last 30 minutes I was starting to get a bit nervous, we dipped below 200 and held there.

But with 10 minutes to go huge buying stepped in and we ripped 10 points, closing the day at $210. This was the trading equivalent of a buzzer beater.

Now I am not usually a conspiracy theorist but if I was, I would say that it was probably the market makers behind the move to expire all of those options that we talked about as worthless.

This is why I try to understand where the smart money is positioned.

I’d also like you to note that these types of moves are not uncommon on a Friday. There are games played to pin stocks at certain strikes and why I make it a point to look at the open interest coming into a Friday.

It is also important to know these levels in case there is breaking news that may push stocks further one way more than might be expected usually, as the smart money is forced to hedge their open options positions with stock, but we will dive into this another time.

Bottom Line

Studying Open Interest and understanding where market makers are positioned is a huge part of my trading strategy. It gives me a chance to be more competitive, and take bets with favorable risk reward, especially leading into option expiration on a Friday.

11 Comments

I never thought of that in that way. It seems like it is controlled by insiders more than the market itself. If you can figure out how to outwit that, I think you can make serious money.

Good idea for more insight into expiration, position and staying profitable.

Thanks !

Great info! Thank You Jeff!!!

i agree with you that fri is always a crap shoot. and sometimes you win and other times not but i like to play fri expiration but do need a better plan.

OK – so what do you recommend?

Hello , I would like to ask if this lesson is free for a student like me ?

I would love to learn it .

wow I seehow playing meme stocks can be exciting if your on a strategy. personally i havn’t had time to fool with them

Jeff,

You are clearly a great teacher of the complex by making it simple.

My friends call me bill. I have been interested in the market since the mid 70s. Like so many others, I was buy and hold forever. I was stunned the first time I noticed the market maker tip their hand. Thank you so much for all you do.

Sincerely,

Bill

Mind blown! It makes so much sense. Of course the market is manipulated. This is but one of many ways. It makes a great case for butterflies & condors. But I’m not a fan of spread trading, I like to swing for the fence. I was taught to look for huge volume at a strike vs. the open interest. (unusual activity) This could explain why this strategy doesn’t always work. Oh, and by the way, Welcome Back. I see all the things you guys are doing to make things right, and I just can’t say it enough. Sincerely,

Helpful, Jeff, thanks! KD

Maybe you could figure a way to incorporate this [these] information[s] into your “bullseye trades”.

I — as well as many others — really like your current emphasis on Teaching us.

Thanks — Mo