One of the holy grails in trading is the ability to pick tops and bottoms. And while it does sound amazing—it’s an impossible task and a significant waste of time.

Instead, I like to follow what real-money traders are doing…since they have skin in the game.

One way to gain access to the most prominent players in the market is by using a tool like the Dollar Ace Scanner.

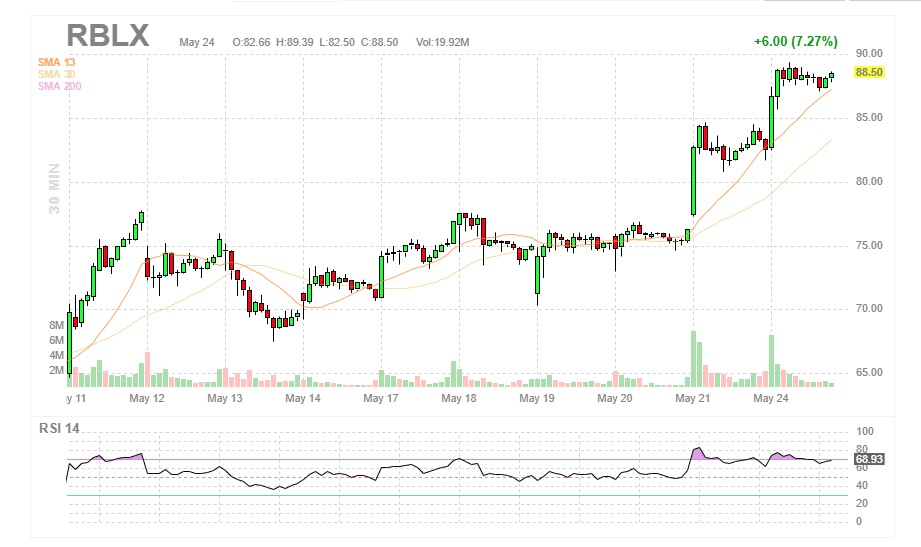

For example, we’ve all seen a massive runup in Roblox (RBLX) over the last week.

Has it gone up too much…too soon?

Or is there more upside in the ticker?

While no one has a crystal ball that can predict the future…I can tell you how some heavy-hitters are playing RBLX via the options market.

In fact, you may even be shocked after reading it.

Roblox Corporation (RBLX) is a global platform where millions of people gather daily to imagine, create and share experiences with in user-generated 3D worlds. The beauty of the platform is you don’t have to be a developer or tech whiz to get started. In fact, it’s kid-friendly.

The price of RBLX shares has exploded over the last two weeks after hitting a low of $60.50.

While there hasn’t been much news in the name…there has been a ton of bullish options action.

On May 10th we saw a trader come in and buy 2485 May21 $76 calls for $1.05 per contract. A $261K bet when the stock was trading at $65.09.

Last Friday there was another round of heavy call-buying. One trader came in and 4888 RBLX June 4th $95 Calls for $1.40 when the stock was trading at $83.

But that’s not all…

One prominent trader bought 2500 RBLX June $110 Calls for $1.85. That is a $463K bet that RBLX continues this run.

Is there upcoming news that we’re not aware of?

Is $100 around the corner?

This information can be helpful even if you are not an options trader. For example, you might think twice about shorting the stock if you saw the bullish call buying. Or it could give you the confidence to buy on a pullback.

One thing we know is that these contracts expire soon…we’ll know if this trader was a genius or if their big bet goes up in flames.

7 Comments

The trend is your friend unless it ends. So there is continuation if you draw the trendline. But that is nowhere near enough to bolster this trade much beyond what the options chain gives you. This needs some some trend analysis. The SMAs here are not even standard fair for trend analysis. Most readers would be more familiar with 20MA/50MA, or 21EMA and 55EMA set ups for obvious reasons. I would apply three: a volume, momentum and price action, indicators. Then as a secondary test I would use three momentum indicators for triple confirmation. You also need to have propriatary trend analysis software that comes with indicator set ups, and or is adaptive to your exchange chart.

Thanks for all the great information.

I know trading Options is the way. How can i get your ticker symbols?

Thank you Kyle, very helpful information. I have rblx position.

that is fabulous news, ths a lot Kyles

Great Information, keep it coming please.

MarioC.

Hi, where do you look to find the options buying and selling activity as mentioned above?

Thanks,