Torchlight Energy Resources, Inc. (TRCH) is a perfect example of why I don’t get caught up in the “Reddit short squeeze” plays.

TRCH is a tiny oil driller located in North Texas. Despite soaring oil prices, they haven’t shown any ability to produce income or even grow revenues…with a sales plunge of more than 97% in the first quarter.

Yet, the stock still shot up from under $4 to nearly $11 as it became Reddit’s favorite short squeeze of the week.

Why TRCH? Surging oil prices?

When you dig in a little, this is not even a play on oil at all…it’s a move out of oil…

Torchlight Energy Resources (TRCH) Squeezes

Over the past week, Torchlight (TRCH) grabbed traders’ attention on Reddit and other social media platforms with hopes of igniting a short squeeze. But, you know…the same thing we’ve seen repeat over and over, starting with GameStop (GME)…read about that here.

Here’s what happened…

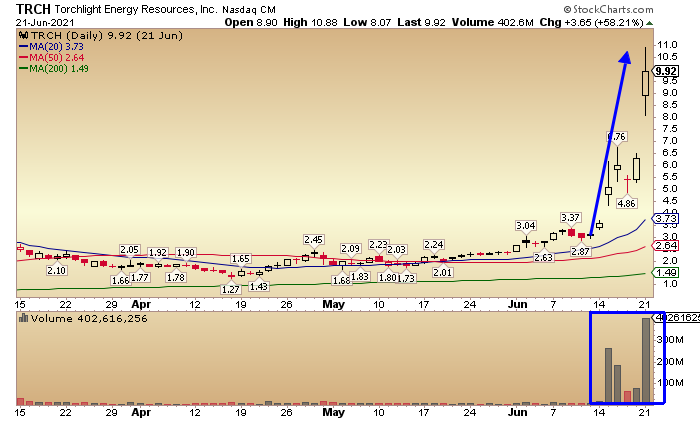

The stock rocketed from under $4 to nearly $11 in just over a week of trading.

While short squeezes can create quick upward moves, they also tend to result in violent retracements as well.

And when a squeeze ends, traders who bought in late often become the bagholders.

Here’s what happened with TRCH…

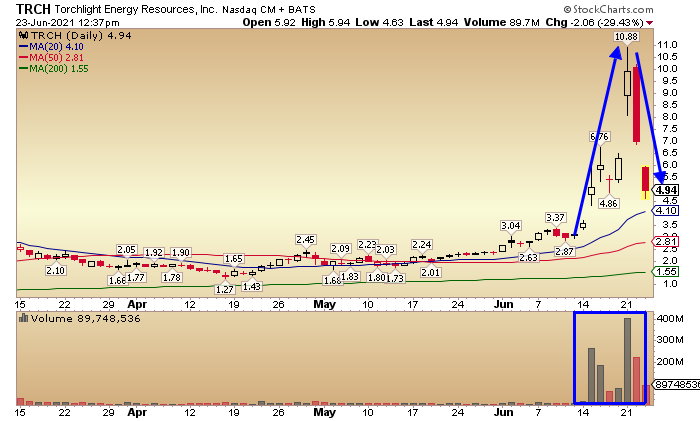

After reaching a high of $10.88, just 2 days later the stock is currently trading under $5.

So what happened?

Cashing in on the retail trading frenzy, TRCH announced an offering of shares to bring in $100 million cash… and then announced an upsizing of that offering to potentially grab another $150M for a total of $250M potential.

Sound familiar?

AMC, RIG, EXPR, GME…

This is the new play by the companies getting massive increases in market cap.

And it’s dilutive to the shareholders at an already inflated price. With that, the panic button gets hit…causing the violent fall back to earth.

But what’s the real story here?

Moving Out of Oil

Torchlight is actually undergoing a complex merger deal with Canada’s Metamaterial Inc. which will ultimately see TRCH abandon its energy operations.

So you mean to tell me I’m not buying a company that is expecting to benefit from the surge in oil prices?

While some unwitting traders may have jumped on an apparent oil play, that’s not what this is…

While Torchlight drills for oil and natural gas it hasn’t produced any profits, and has no intention of continuing down that road.

On the other side of this story is Metamaterial Inc., which designs and manufactures advanced materials and functional films engineered at the nanoscale to control light and other forms of energy….they encompass lightweight, sustainable raw materials and processes which consume less energy and offer more performance.

Basically, it’s a materials research and development company trying to develop new and better materials for the future.

And in the end, the whole purpose here is to get Metamaterial a U.S. listing on a major exchange without having to go through the long expensive process of an IPO.

When you look into it, Metamaterial Inc. is actually an interesting company. But it’s not Torchlight and has nothing to do with the increase in oil prices. This is simply a move to get a US listing.

When big moves happen, be sure you know the underlying reasons. It’s not always what it seems.

If you want to invest in Metamaterial Inc., it might be best to wait for the merger to finalize and the stock to settle down.

TRCH may have come back down to earth, but that doesn’t mean it’s over. The merger has been pushed back a few times…so it could be volatile for a while still.

They also announced a special dividend to shareholders of record as of close on June 24.

This is part of the merger…as mentioned, this is not about the future of oil, the plan is to sell off the oil and gas assets and pay the proceeds out as a special dividend.

How much is this worth? It’s unclear and hard to value as analysts’ expectations are all over the place. Regardless, this could add some volatility off the current $5 price as traders look to value that dividend along with the potential merger.

Needless to say, it’s complicated.

And it’s unlikely that Reddit investors are fully done messing with this stock. In my opinion this is a meme stock to walk away from. With so many variables and unknowns, I would rather stick to classic chart setups like the stair step or consolidation breakout…

1 Comments

V good