There is nothing riskier than shorting a stock naked. Just ask Gabriel Plotkin of Melvin Capital. Melvin Capital, the hedge fund at the center of the GameStop (GME) trading frenzy, lost 49% on its investments during the first three months of 2021, a person familiar with the matter said back in April 2021, as GME soared from under $20 to over $450 in a few short weeks. That was a loss of over $5 billion!!!

Mr. Plotkin is not the only one to get caught making this mistake. I know great experienced traders that have lost years of work getting caught in a short squeeze without proper risk management, as well as inexperienced traders in stocks like GME, AMC, and TSLA.

I rarely go short.

Why?

We’ve been in a secular bull market since 2008. Of course, there was a massive opportunity when Covid rolled around, but even that opportunity only lasted one month. I usually prefer to get long, strong stocks.

However, I’ve noticed a lot of weakness in the market breadth over the last couple of months, and sooner or later, a bear market may rare its head. Thus I feel that there may be more good risk/reward opportunities to short the market on the horizon, and I have found one in GOOGL this week.

Alphabet Inc (GOOGL)

GOOGL is trading higher from pivot lows and support zones where the bulls stepped back in and drove the stock higher.

But I’ve been feeling that this has moved too far too fast, and now that we are up against the 100 daily moving average, the bears might be here to defend their territory again.

Now going short a $2800 stock is very risky! So what else can a trader do?

Trade the options!

Traders get the benefit of a defined risk strategy with the leverage they need to own 100 shares of GOOGL without putting up $280,000 of capital to trade.

How is this done?

With a credit call spread strategy!

Trading Lesson: Credit call spread

When you want to short a stock without buying expensive put options or taking unlimited risk on the stock itself – one way you could do this is by selling call spreads.

A credit call spread is also called a bear call spread, and it is used when traders want to take a short direction in a stock without buying expensive premiums in the options market.

Put options are inherently more expensive than calls simply because investors are using the options markets to hedge against an adverse move in the underlying stock that they are holding in their portfolios.

What benefits does a trader have for selling a call spread vs buying a put vs selling the stock?

When a trader sells a stock, they are ultimately accepting unlimited risk on their trade. If GOOGL opens at $300k / share up from $3k / share, the trader would be responsible and would most likely suffer catastrophic capital losses to the business they work for or themselves personally, such as that experienced by Melvin Capital in Gamestop (GME).

When a trader buys a put, they are trading against the market makers who increase the value of the put options based on the market environment. If more traders are expecting the value of GOOGL to drop, the market makers will increase the price of the options to compensate for their risk. This increase in premium is tied into the Implied Volatility of the options contracts and does not work in a trader’s favor.

So what’s left?

A Credit Call Spread is considered to be the best strategy for trading a directional move in the stock since it’s a delta-based strategy and removes any associated volatility risk from purchasing put options. It is also considered to be a better strategy to trade since it has defined risk and reward zones that a trader knows will protect him in the event of an adverse move.

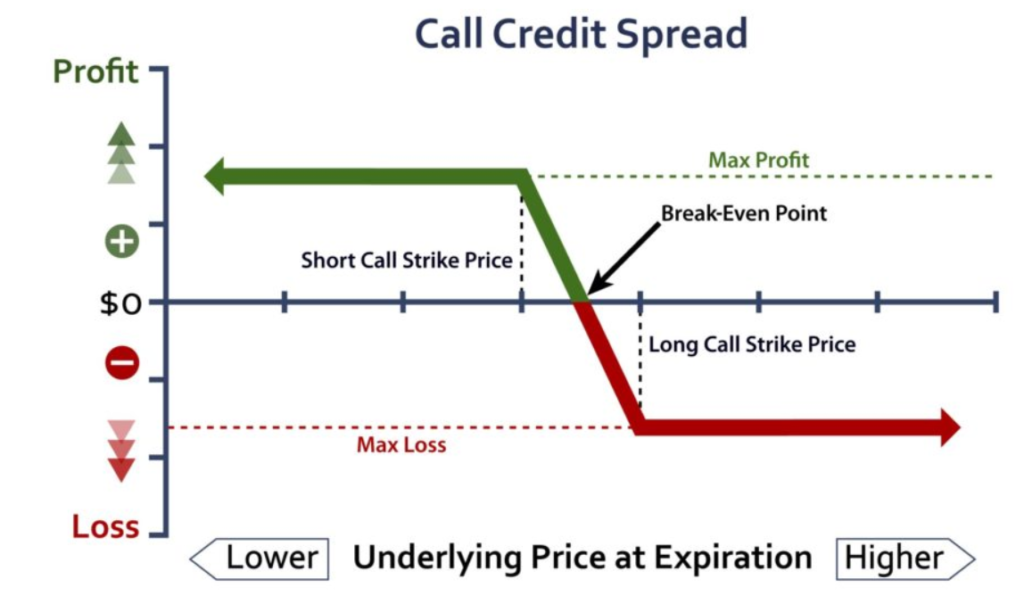

What does a credit call spread look like?

Credit Call Spread:

How does this look as a trade?

The Trade

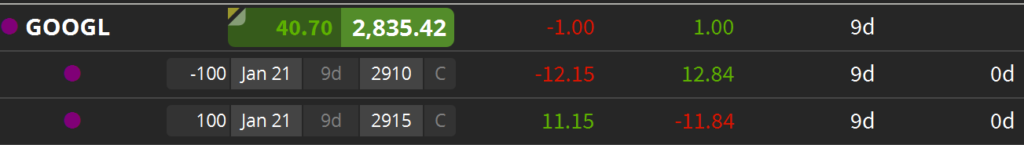

As can be seen above, I’ve sold the 2910 calls and bought the 2915 calls in GOOGL to create a Bearish call spread expiring Jan 21. So long as GOOGL is below $2910 on the Jan 21 close, I will collect the full premium received. More importantly, if I am wrong on the trade and GOOGL goes above 2915 to any price to infinity, my risk is defined as the calls I have sold at $2910 are hedged with the calls I bought at $2915.

By selling a call spread, I have defined my risk and am also able to trade higher-priced stocks with less capital upfront because my risk is much less than shorting or selling puts naked! This is how you can bet on a stock going down safely without risking blowing up your account!

Bottom Line

Many traders, experienced and new alike, have made the mistake of shorting a stock naked.

When you short a stock naked, your risk is unlimited and can put your entire trading account and trading career at risk. When a short squeeze occurs and stocks go much further than expected, emotions come into play, and I’ve seen many traders experience tremendous pain, emotional and financial, as stocks continue higher.

One way to avoid such a disaster is to sell call spreads. By doing this, I can collect the premium received from selling the spread if the stock stays below the lower strike price of the put I sold. If the stock continues higher, my risk will be defined at the outset as the call I buy hedges the call I sold.

There is even a more advanced trade structure called legging into a spread, but I will leave that for another day. The best traders always focus on how much they have at risk, not on how much they can make!